As last week ended the Dow was in yet another undeserved rally, recouping fully half of the 300-point loss it suffered earlier in the week. And yet, with exuberance gushing back into the markets, we found ourselves irresistibly drawn to…put options. Hours earlier, we had missed buying some November out-of-the-money QQQ puts by two cents, and although this left us feeling slightly remorseful at the bell, we were cheered when it was reported after the close that Apple had been awarded $1.1 billion in its patent infringement suit against Samsung. To be sure, the news itself was bad for consumers, bad for Samsung in particular, and bad for the retail electronics business in general. As how could it not be? Apple’s victory has redefined patent infringement so broadly that, henceforth, any consumer electronics company with a designn idea is now at least somewhat more likely to find itself blocked or intimidated by a competitor’s patents.

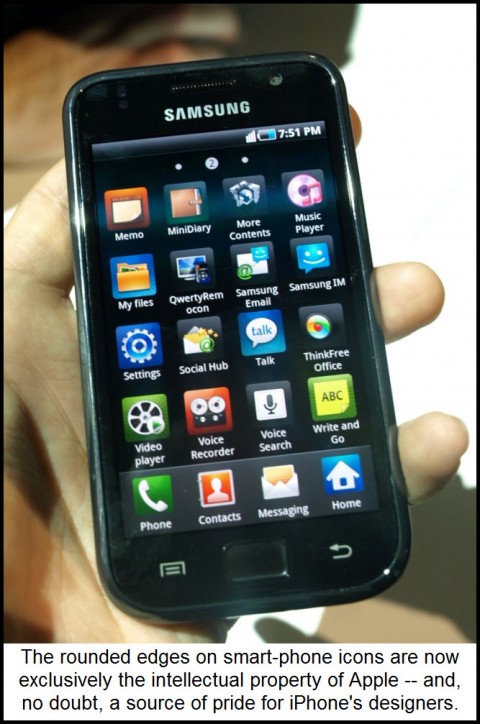

Or so it would appear. Although we have not pored over the legal minutiae, we trust that a news report we read got it right in characterizing the lawsuit as pivoting significantly on “rectangles” – specifically, the size and shape of icons that can be maneuvered across a smart phone screen with one’s index finger. Apple’s lawyers had claimed Samsung “stole” the shape of these rectangles, among other things, and now, unfortunately for all of us, the alleged theft has been defined in law so that any firm seeking to enhance the look of a smart phone screen with new shapes, designs or functionality will think twice before making such features commercially available. And never mind that a fifth grader could have thought up the prosaic “innovations” that Apple has just won more than a billion dollars for patenting.

Ripe for Correction

So why did the news cheer us as we looked for ways to short the market on Friday? For starters, in after-hours trading Apple was in yet another short-squeeze parabola, one that could conceivably create a blowoff top. We were already short AAPL when Friday’s session began, but with a short-put “kicker” that could actually make us a few bucks if the stock does one last head-fake before going into the correction we expect. We initiated our three-sided “roller coaster” position with a recommendation last Tuesday to buy some put calendar spreads that made us moderately short Apple with a December horizon. Then, the next day, we advised shorting some September 615 puts for $620 apiece (being short puts is equivalent to being long the stock). With Apple’s rise since last Wednesday, the short puts have already fallen in value by half, producing a theoretical gain for us of about $300 apiece that will serve to offset the $1400 cost of our calendar spreads. The spreads will have four months to “come home,” incidentally, and it may be possible to further reduce their costs basis by short-selling November 620 puts when the Octobers we’re currently short expire. (This is known as “rolling” the position.)

To be sure, we love Apple shares as much as the next guy. It’s a great company. But our gut feeling is that the stock is overdue for a correction, having rallied more than 20% in the last month to a so-far all-time high of 675. Under the circumstances, a pullback of perhaps 60 to 100 points in the weeks ahead would be both healthy and normal. And hey, there’s always a chance that Apple has queered its good karma by turning its big guns on a squirrel. We’ll know in a few years, but you read it here first.

Meanwhile, the other reason we are looking forward to Monday is that Apple’s strength has the potential to pull the broad averages higher, giving us another chance to buy the QQQ puts we were unable to buy on Friday. With any luck, they’ll come to us cheaper than the 0.75 we were bidding last week, giving us a low-risk bearish play into autumn.

What About Dow 14000?

A bearish play? Some readers may be puzzled, since we predicted here a short while ago that in the lead-up to the election the Dow could go as high as 14000 — about 800 points above current levels. Of course it could. But we also said we’d stay close to the fire escape — just in case. This we have done via the tactics described above. We might also have a chance to turn our short September 615 puts into risk-free spreads if the broad averages remain buoyant this week. That would entail buying put options of a higher strike for less than we received for the short September puts. We’d be locking in vertical bear spreads with no possibility of a loss, in effect getting free puts. If you’re interested in seeing exactly how we do this, and in receiving real-time e-mail alerts as the process unfolds, click here for a free trial subscription to gain immediate access to all of Rick’s Picks services and features, including a 24/7 chat room that draws gifted traders from around the world.

Since Rick seems to trade mostly option spreads, and legs into them at favorable prices on both sides, he seems to make profits regardless of whether the market falls or rises. But I would not be surprised to see Dow 14K by the election, as his pivots are predicting, despite his “staying close to the fire escape” in case he needs to exit.