With U.S. stocks blithely on the rise against a darkening global economic picture, we keep telling ourselves it’s only a movie, it’s only a movie, it’s only a movie. Except that it isn’t a movie. It’s an epochal tide of delusion; it is quite real; and if it hasn’t yet reached flood levels, it will soon, inundating stock markets around the world. For now, though, even as those once-tireless engines of growth, China, India and Brazil, grind their way toward economic limbo and the growing likelihood of synchronous global recession, it is still evidently possible for the Wall Street Journal to fairly rejoice over July’s modest 0.8% rise in retail sales. Hallelujah! At long last, Americans have opened their wallets. After a three-month string of declines, the Journal need hardly have reminded us that three-quarters of U.S. GDP is consumption-based and that a sustained uptrend in retail sales is therefore crucial to reviving consumer confidence and, in turn, economic growth.

Would that a one-month credit-card spree were sufficient to lift us from the Great Recession! The term “Great Recession” itself is used by everyone outside of politics and the news media to scandalize economists’ declaration in 2009 that the recession had ended. Yeah, sure. Tell that to twenty million homeowners who are still underwater in a housing market that has barely upticked on 3% mortgages. Or to millions who are either unemployed or earning far less than they did before the financial crash. Or to legions of former shopkeepers who have abandoned storefronts and malls, turning the retail landscape into a visual reminder that the recession never really ended. The Journal is hardly alone in cheerleading every statistical uptick that could serve to distract us from the previous day’s grim economic tidings. The public may have a short memory, but not that short. Nor does anyone believe, even on Wall Street, that a rising stock market is evidence of America’s return to economic health. To the contrary, they see the bull market as a terminal effusion of hubris, corruption and greed.

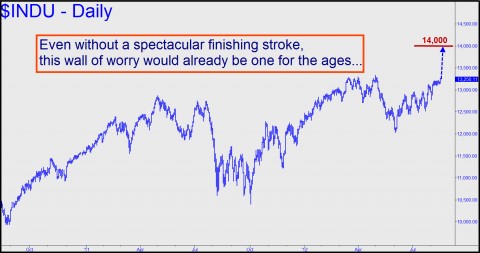

If you truly believe that the U.S. is an oasis in an economically troubled world, then go ahead and buy the Dow up to 14000 (where it seems to be headed anyway, according to our technical runes). Meanwhile, although it is folly to think America will somehow avoid the grim economic fate of Europe, this is the story that the Wall Street Journal et al. would have us believe each time a stray piece of “good” news hits the tape.

***

Trading stocks, options and commodities in these treacherous times calls for great patience and skill. Click here if you’d like to see how Rick’s Picks approaches the challenge.

Stock rally could continue until year’s end. U.S. dollar might instead decline, while gold could rise.

There is a great risk in trading