As usual, the stock market was vexatiously out of step with reality last week, soaring on word that the ECB plans to do “whatever it takes” to preserve the euro and the political union that it binds. For U.S. investors, especially those who believe in hope and change (and, presumably, the Easter Bunny), there was also the invaluable news that the U.S. economy is once again verging on recession – a development which is widely believed to portend yet more Fed easing. Completing the delusional vision that good times are soon to return nonetheless, crude oil finished the week with a gain of about $4 per barrel. Of course, no one actually believes that so strong a recovery impends as to squeeze current supplies of crude that are more than adequate. Even so, the news media, feigning ignorance of forces that have been pushing the global economy toward an abyss, and abetted by the stock market’s steroid-addled lunge, were only too happy to report events in a way that did not challenge officialdom’s cynically crafted, positive spin. The Establishment’s most useful memes were dutifully trumpeted by The Wall Street Journal in two headlines that ran above the fold on Friday: Weak Economy Heads Lower, said the topmost, in a heavy font; and, immediately below it, in italics, the implicitly good news: Markets Jump as European Leaders Vow to Protect Euro; Flagging U.S. Recovery Could Spur Fed.

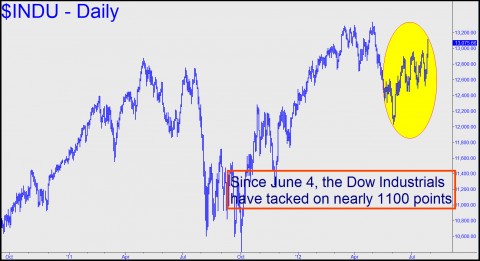

Such headlines have the seeming heft of history-in-the-making. Notice, however, that it is not facts that have borne this weight, but mere hope and speculation. To say the markets have responded positively to some banker’s speech is hardly an assurance that the ECB’s latest nostrums will work. As for the Fed’s supposed ability to revive the economy with yet another monetary nudge, it is only on Wall Street where the cynicism such speculation evokes could produce an ostensibly positive outcome – i.e., last week’s 600-point surge in the Dow. Despite such effusions, however, there is growing tension between the stock market’s ebullient leaps on the one hand and mounting perceptions on the other that the global economy is poised to collapse. Under the circumstances, we imbibe headlines like the ones above with a growing sense of foreboding. The reassurances that our leaders seem increasingly desperate to promote are perforce muted by the echo of headlines from the past. Below are a few to ponder as we bear witness to the stock market’s inscrutable rise. All appeared on the front page of The New York Times during the summer of 1929. While a few of them suggest that little has changed, others seem ominous in hindsight:

- Leaders Assure President Senate Will Cut Tariff to Protect the Consumer

- Stocks Set Record as Money Drops to 6%

- London Suffers Record Heat; British Drought Most Serious

- Britain Won’t Join Neighbors in Tariff War with America

- Red Army Reported Massing on Frontier of Manchuria

- Three Banks Closed by State In Passaic; Quick Sale Forecast

- Heat of 91 Kills 3; Squalls Sweep City

- U.S. Steel Profit at Peace-Time Peak

- Baby Auto for Two to Be Sold by Mail

- Mercury Drops to 56 Degrees in Coldest Aug. 5 Here

- Farms Ship Wheat in Record Volume

- Capone Shifted to Another Prison Because Fellow Inmates Threatened Him

- Stock Prices Break as Rise in Bank Rate Starts Selling Rush

- Stocks Regain Half of Friday’s Losses

- Bank of England to Get $250M [from Fed] if Necessary

- China Says Soviet Is Trying to Start World-Wide Revolt

- Stock Market Goes Up, Surprising Wall Street; Brokers’ Loans at Peak Had Indicated a Drop

- Arabs Invade Palestine from Three Directions

- Turks Threaten to Seize Synagogue in Tax Dispute

- Heat at 94 Again; Wave Nation-Wide

- Stock Prices Break on Dark Prophecy; Follows 19-Day Advance [September 6]

- [Professor] Finds Nation Lacks Direction Because Teaching Is in Hands of Women

- Senate Foes Attack Tariff Bill

- Boy Held in Theft of $512,000 Bonds

- Stock Leaders Sag in Liquidation [September 25]

- Toppling Markets Rallied by Bankers [September 26]

- Maniac Kills Man by Push on Elevated

- Hoover Defeated on Flexible Tariff

- $1,253,702,357 Rise in Taxable Realty on City’s Rolls

- Year’s Worst Break Hits Stock Market [October 4]

- Brisk Rally Checks Long Market Drop [October 6]

- Radio Carries Cheer to Byrd in Antarctic

- Hoover to Attend World Series Game Today

- Stocks Driven Down as Wave of Selling Engulfs the Market [October 20]

- Stocks Gain Sharply but Slip near Close [October 23]

And we all know the rest. If there’s a lesson in this sequence of headlines, it is that we should batten the hatches if and when the stock market’s daily gyrations become front-page news in the The New York Times. Of course, the worst conceivable outcome would be a market that fails to gyrate, instead collapsing in a flash crash so devastating as to crush all speculation about a recovery.

***

Trading stocks, options and commodities in these treacherous times calls for great patience and skill. Click here if you’d like to see how Rick’s Picks approaches the challenge.

since it appears no one here understood my satirical piece above on gary, about his fawning admiration for buffett, and trying to make him out as some saint (just because he has lived in same house for 50 yrs, and only had 1 wife according to his “facts”, and was donating most of his wealth away after death), here’s what I was attempting to point about gary, and buffett:

first,

from my view, gary’s general “facts”, in most of his posts, always distort the truth in some way, by solely looking at whatever he is addressing within a very narrow context; and primarily because he not only constantly ignores the bigger picture of the unpayable world debt of 1 quadrillion, but he does not even consider it, as important at all.

Additionally, gary’s “facts”, are constantly partially laced with b.s. he makes up himself (to supplement whatever his argument is), such as saying that his “saintly” buffett had only been married once; when in FACT, he had been married twice, and had lived with ex-wife’s younger nurse, since 1977 (now 35 years together), and when he dumped his invalid wife out of the house, and just kept his new hottie.

And gary does this all the time, citing distorted “facts” that he makes up, to complement his overall arguments.

On top of this, I have also caught gary plagiarizing articles off of ‘yahoo finance’ page, in which he not only presents data cited in the article as his own research, but he actually even writes herein almost all in the article near verbatim, without quotations, trying to pass it off as his own words.

Suffice to say, I stopped taking gary seriously long ago, so I mostly scan quickly through his dozens of long daily permabull posts, looking for something to laugh about, something particularly absurd to enjoy ridiculing, and show him for what he is, IMO, a total charlatan.

And I have wondered by permabull gary even comes to this site to write over a dozen long posts per day, since this is a permabear site, in it’s core constituents.

And all I can think of, is that he is retired, a stay at home guy with not much to do (since as he has stated repeatedly that he is not even investing now), and that he likes to play the devil’s advocate, be this site’s contrarian, and for some unknown reason of his own.

I also wonder why redwilldanaher bothers to invest so much of energy to attempt to refute this narrow-spectrum, tight-blinders, stubborn permabull guy; a guy that, has already proven to me, repeatedly, to be quite the made-up bull sh–tter: so how can anybody take this guy seriously, except maybe as this bear site’s permabull court jester?

so that was my main point about gary above.

that he makes up “facts”, to suit his distorted, narrow arguments.

second,

my point on buffett had nothing to do with adultery, that was incidental, I only used it to satirize gary’s 1-wife “fact” (only proper way to treat the narrow-minded garys of the world).

no, my point on buffett is that buffett is a shark, and a bigtime insider shark, and no saint at all, as gary tries to paint him (you can almost gary’s picture of a white picket fence, with the 50 yr old home behind it, and “good” warren and wife holding hands and laughing at front, like in a norman rockwell painting).

My main point above re buffett, which no one addressed nor refuted either, is the FACT that buffett saved both goldman in 2008, and bofa in 2011, and both times, because the goobermint’s Fed could not do it directly themselves, without breaking the law in 2008, and without raising major banking concerns over the health of all big banks, in 2011.

And buffett came to the rescue both times, not because he was a ‘nice’ guy (just the opposite, he is a shark), he did it because he is a bigtime insider, one of the top ones, and he lent these 2 banks billions of dollars in their default-crisis moment (and remember, these 2 banks are 2 of his own biggest competitors, since one of buffett’s main longtime darling large stockholdings, is wells fargo), he did it because being tight with the goobermint is more important than enriching wells fargo, or any other stockholding, since to always have pre-event insider information, is what’s critical: pre-event political info, financial info, etc. For that insider pre-knowledge is more valuable than anything.

additionally, the world debt situation is so bad now, that if buffett had allowed bofa to go under in 2011, and that would have made it possible for wells fargo to acquire 100’s of bofa’s branches for pennies on the dollar, the ensuing financial chaos in that would have occured in 2011, would have been injurious to all his stockholdings including wells fargo itself, since the failure of bofa would probably have created panicked bank runs, on all the other big banks, then all financial hell would had broken loose, so bofa HAD to be saved from default, by somebody, so why not him, to give even more power, and more insider leverage, when the unavoidable world-debt collapse finally came.

Therefore, everyONE related to big banks and the govt. is a total lynig scammer, with buffett included, and he’s one of the biggest liars of all, because of high billionaire “sage” profile.

By now, the unsustainable unpayable world debt, of both nations and large banks is so huge, that the liar-balls must be juggled daily and continually in the air and as long as possible, no matter what, with no crack of truth ever revealed by ANY insider; and to the point that even competitors, like the big banks, have to bite the bullet and band together, along with the govt., until the very end, when it all finally IMplodes together; and on the day least expected by the masses of sheeple “investors” and depositors.

yet: those ‘in the know’, like the shark buffett, will know way ahead of the event, of the exact day that it will occur; and trust me, on that day, these 1% insiders be ready to screw the masses as deeply and permanently as they can. And I am sure also, they have all the NEW rules and regulations over americans, all setup already and waiting, for when this unavoidable event occurs.

And I don’t blame them, because if I was one of them, I’d do the same.

woody allen said it best, in annie hall:

alvy:

“Lyndon Johnson is a politician. You know the ethics those guys have? It’s a notch underneath child molester.”

his girlfriend, in bed:

“Then everybody’s in on the conspiracy… The FBI and the CIA and J. Edgar Hoover, the oil companies… the Pentagon, the men’s-room attendant at the White House?”

alvy:

“I would leave out the men’s-room attendant.”