In yesterday’s commentary, we cited the punk performance of Apple shares in recent weeks as evidence that the stock market as a whole may have entered a bear market. “Apple as a barometer? That’s a big stretch,” wrote a regular contributor to the Rick’s Picks forum. We disagree. After all, Apple is the most valuable publicly traded company in the world – bigger, even, than Exxon Mobil. Given the extraordinarily high expectations that investors (and consumers) have for the company, even a small disappointment – a downtick in sales, perhaps — could hold serious implications for Apple shares. That in turn could precipitate a major trauma on Wall Street, since so many portfolio managers owe their bonuses in recent years more to Apple’s steep rise than to any other factor.

Investor sentiment aside, Apple’s continued success as a retailer is crucial to a segment of the economy that has been devastated by competition from the Internet. As brick-and-mortar stores have fallen one-by-one, Apple’s showrooms have thrived, with lines out the door whenever new products are released. Under the circumstances, the much-awaited iPhone5 had better be stellar in every way, since Samsung will be breathing down Apple’s neck with strong new products of its own. Nor are consumers likely to be impressed by merely incremental improvements. It takes a lot of Wow! factor to get them to pay up for Apple’s relatively pricey hardware. They are going to be even more demanding as new pricing schemes being rolled out by the phone companies effectively reduce or eliminate the subsidy that has made many smart phones a giveaway item when tied to service contracts.

Bear Still ‘Speculative’

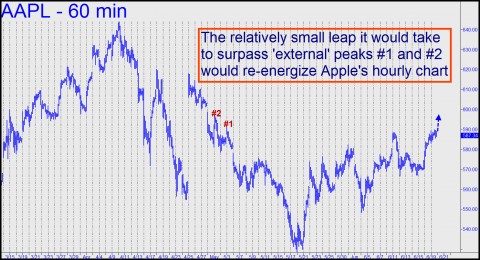

From a technical standpoint, the presumption of a bear market in Apple shares is still speculative. Rallies have lacked their characteristic oomph in recent weeks, even as corrective downtrends have exceeded our Hidden Pivot targets. Still, that’s nothing that a burst of energy could not cure in a week – or even in a few days, since bulls could go on the attack again with a booster-stage rally of just $10. Notice in the chart above that that would surpass two prior peaks that occurred in early May. It may look like small stuff on the chart, but it would generate the first robustly bullish “impulse leg” of hourly-chart degree since late April. We’ll reserve judgment until we’ve seen how the stock handles these “external” highs. In the meantime, Apple should not get a free pass merely because the company and its products still generate more buzz, and its showrooms more traffic, than any other company in the consumer electronics business.

Android outselling iPhone 2:1 with Siri unintelligible mish mash, contrary to AAPL ads, a recipe for disillusionment.

http://www.nytimes.com/2012/06/11/technology/apple-keeps-loyalty-of-mobile-app-developers.html?pagewanted=all

AAPL headed south today so far with Crude, PMs and FX, despite targeting +13% on Point and Figure.

Found covered calls limit upside and do not hedge downside…