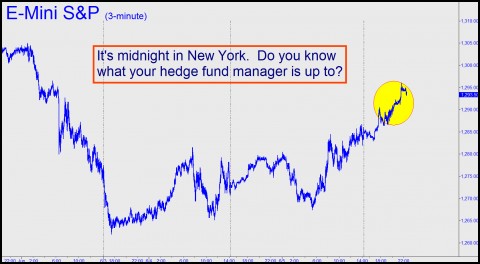

Index futures were wafting higher Tuesday night, presumably made buoyant by the absence of volume and an apparent dearth of sellers. For DaBoyz who run this nightly carny game, such rallies present an opportunity to induce a short-covering panic — just the thing to distribute shares to widows and pensioners who still don’t suspect stocks may have entered a bear market. At the moment, however, the missing ingredient to produce the wished-for buying panic is some mote of news that might support Wall Street’s cherished mirage of a world in which troubles melt like lemon drops.

Not in Europe, though, and not tonight. Usually, when we see the Mini-S&Ps up more than 10 points late at night, as is currently the case, it means that delusions about Europe getting its financial act together are waxing rather than waning. This evening, however, we are seeing a bizarre inversion of the usual dynamic: Stocks are rising in Asia not on speculation that Europe has resolved some aspect of its dilemma, but because it can’t, and won’t. Specifically, it is Spain that is getting pummeled today, shunned by the credit markets and worried that it won’t be able to meet payroll if it doesn’t receive a fresh infusion of credit, pronto.

Years of Claptrap

In a financial world not run by crooks, sociopaths and imbeciles, this would be taken for bad news. But the markets are in fact controlled by such types and worse, and so we see shares rallying tonight on hopes that Spain’s increasingly dire plight will call forth yet new and vast sums of stimulus money – and not just for Spain, but for all of Europe. It is an affront to civilization itself that this kind of thinking should rule global markets and therefore, in some fashion, our daily lives. Even though it has been going on for years, it beggars believe to think that anyone even remotely believes such claptrap. Certainly not the crooks and imbeciles who gamble with Other People’s Money (OPM) as though it were…other people’s money. Not a one of them could possibly expect a happy outcome for Greece, Spain, Italy et al. But when it comes time to place their bets, they toss their chips onto the “pass “ line, sticking to their story. For its part, the news media, ignorant and complicit, claps with the dim enthusiasm of a trained seal. For seven days’ free access to all of our services, including detailed daily trading recommendations and a 24/7 chat room that draws traders from around the world, click here.

then there is

ensure vs. insure!