So engrossed were we in dissing Facebook’s IPO that we almost failed to notice that the stock had recouped nearly 40 percent of the losses it suffered after mid-May’s abortive IPO. FB opened that day at $42 and shot up to $45 momentarily before embarking on a three-week dirge down to 25.52. That low was hit on June 6, but the shares have since perked up a tad, hitting a recovery high of 33.45 last week. On Wall Street, where too much of a bad thing can hold perverse enticement for opportunity-starved investors, perhaps all that was needed to attract a new wave of buyers was a little bad publicity. That, the company has gottern in spades. First came the fallout from the IPO itself. Investors are claiming $500 million in losses caused by glitches in Nasdaq’s order system. Some who bought the stock that day may wish they hadn’t, but it’ll be interesting to see whether the size of their claims shrinks or grows as Facebook creeps back toward its IPO price, as seems possible.

Other, recent news stories have reflected poorly on Facebook’s business model, which entails gathering as much intelligence as it can on 900 million users and selling said data to advertisers. Nothing wrong with that, of course — asssuming that the fact-gathering is on the up-and-up and the information is not abused. Unfortunately, Facebook has flunked on both counts, and badly. A couple of weeks ago, there was the widely circulated story about a web surfer, Nick Bergus, who stumbled on a 55-gallon vat of sexual lubricant for sale on Amazon. Bergus posted a link to the item’s Amazon Facebook page and jokingly inserted the caption: “For Valentine’s Day. And every day. For the rest of your life.” Amazon took Bergus’s “endorsement” and ran with it, appropriating his Facebook photo for a full-blown advertisement. On his personal blog, Bergus had this to say about the experience: “I’m partially amused that Amazon is paying for this, but I’m also sorta annoyed. Of course Facebook is happily selling me out to advertisers. That’s its business. That’s what you sign up for when [you] make an account. But in the context of a sponsored story, some of the context in which it was a joke is lost, and I’ve started to wonder how many people now see me as the pitchman for a 55-gallon drum of lube.”

E-Mail Grab

Facebook was at it again the other day, gaming users’ pages in an unsubtle attempt to force them onto its e-mail system. Although everyone with a Facebook account receives an @facebook.com e-mail address whether he or she uses it or not, Facebook recently began posting the addresses to users’ profiles and showing them as default email addresses. “Facebook silently inserted themselves into the path of formerly-direct unencrypted communications from people who want to email me,” one irate blogger noted. “In other contexts, this is known as a Man In The Middle (MITM) attack,” he wrote, referring to a tactic hackers use to intercept electronic messages. “What on earth do they think they are playing at?”

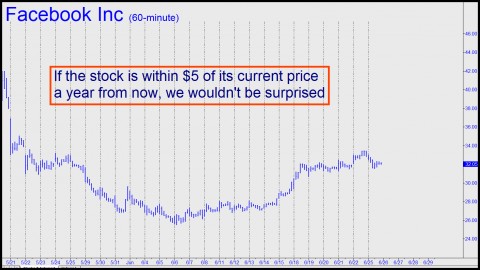

Will all of this matter to investors – or for that matter, to Facebook’s vast user base? Perhaps not. It’s possible Facebook will be able to get in subscribers’ faces even more aggressively and obnoxiously, serving them up sliced, diced and pinpoint-targeted to advertisers without alienating too many of them. Our gut feeling, though, is that the company, $100 billion capitalization and all, will be toast if just a few more privacy scandals hit the front page. At best, we see FB shares trading a year from now within $5 of their current price of around $32. If you like the stock but suspect the company’s revenues will not be commensurate with a $100 billion capitalization, selling covered writes would be the way to go, since premiums for near-the-money calls are quite juicy. And by all means, come back in a year and tell us how you fared.

***

If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

In Europe, credit-agencies were angling for software that would permit them to evaluate FB profiles, and put the data from there, however, into their credit-modeling.

Just another way one screws oneself by using FB.

As to privacy scandals hurting FB:

don’t think so, people are so addicted to it, you can tell them all about it, they still won’t leave.

Same for cell-phones:

THere is already enough evidence out there that cell phone technology is not safe, especially for constant-chatters (hours per day with set at head) or even just a turned-on cell in the pocket (men: care to irradiate you know what all the time?).

Yet, people are unwilling to even listen, because accepting that reality and acting accordingly, that is turning the damn thing of for most of the time, and only using it when needed, is a fate worse than death to these people.

Even worse the damage to a growing body, and kids are probably the worst cell abusers, and the most likely to suffer long term consequences for it.

Critics are just dismissed as curmugeons, and it is what most people want to hear…

I-phone addicts?

With its relay-ping-pong technology, that one is even worse, it’s not even off when it’s off (airplane mode anyone)?

Why do I want to be the retransmitter for anyone else?

As someone commented last year:

“the cell phone will be to the 21st century what the cigarette was to the 20th”.