[This commentary has elicited such a spirited discussion, including ruminations on the inflation/deflation conundrum, that I’m letting it run for a second day. RA]

Are gold and the bloodied mining stocks at an important turning point? So it would appear. Persuasive evidence of this came together for us yesterday after we ran into an old friend, a real estate developer with a commodity-trading jones, who asked whether it might finally be time to buy the stuff. “Buy it?” we replied. “We’ve been trying for a week to buy anything gold-related but it’s like trying to catch a jackrabbit.” Hmmm. Is gold trying to tell us something? Signs had been accumulating. When we turned in late Sunday night, we felt comfortable with a futures “tracking” position in gold acquired near Friday’s lows. Using a Hidden Pivot “camouflage” strategy, several subscribers reported buying the Comex June contract for around 1654.30, based on a playbook sketch accompanying Friday’s trading touts. Later in the day, with gold in a strong rally, we advised taking partial profits that would have reduced the theoretical cost basis of the position to 1641.50. With the futures trade near 1665.00 Sunday night, how could we lose? We advised subscribers to use a 1649.10 stop-loss for what remained of the position.

The chart above tells what happened next. Although June Gold was practically unchanged as we went to press Monday night, an intervening swoon of $40 — $20 down, then $20 up – had taken us out on the stop-loss Monday morning, as it must have many other traders who fancied themselves sitting pretty Sunday night. Now the task of climbing back on board will be doubly difficult, since gold is taking increasingly radical evasive maneuvers to disabuse its growing fan club of the notion that it will be easy to make money on the long side merely because the trend is up.

Leaping Out of Reach

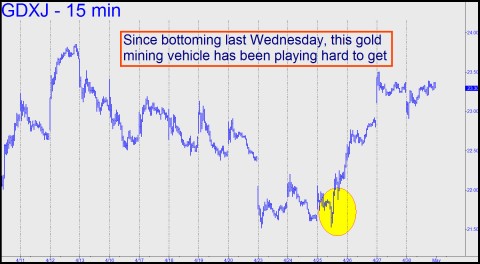

The action has been even more frustrating – and commensurately more bullish — in some gold ETFs popular with Rick’s Picks subscribers, including GDXJ, a proxy for the shares of junior mining companies. We scratched long positions three times in the last two weeks as GDXJ bounced from successively lower bottoms anticipated by Hidden Pivot analysis. We held no position when last week began, figuring we could easily jump back in if there were bullish stirrings. Lo, GDXJ took a powerful leap from a 21.53 trench last Wednesday (see chart below) and hasn’t looked back since. By Friday’s close, this trading vehicle had achieved 23.50 – a 9.3% rally in the space of just three days. Making GDXJ even more difficult to buy “right” is the fact that its pullbacks have been shallow even when physical metal was flat-to-down intraday.

What turned our observations into an epiphany, however, was the note we received yesterday from Phil C., a gifted chartist whose impressive track record took a nasty blow a while back when he put out a very aggressive buy recommendation on Kodak just before the stock deep-sixed. This time, he is just as sure: “We are at the end of the precious metals correction that has been in place since last year’s highs. Gold and silver have both completed, six-month reverse head-and-shoulders bottoms. The next move higher should start tomorrow, May 1st!” Phil’s misstep in Kodak shares aside, we think he’s going to be right this time. Gold (and silver) are carving out a bottom distinguished by its viciousness. If you want to join us as we look for a risk-averse way to ride the Brahma bull, click here for a free 7-day trial subscription that will give you access to all Rick’s Picks services, including a 24/7 chat room that draws traders from around the world.

What turned our observations into an epiphany, however, was the note we received yesterday from Phil C., a gifted chartist whose impressive track record took a nasty blow a while back when he put out a very aggressive buy recommendation on Kodak just before the stock deep-sixed. This time, he is just as sure: “We are at the end of the precious metals correction that has been in place since last year’s highs. Gold and silver have both completed, six-month reverse head-and-shoulders bottoms. The next move higher should start tomorrow, May 1st!” Phil’s misstep in Kodak shares aside, we think he’s going to be right this time. Gold (and silver) are carving out a bottom distinguished by its viciousness. If you want to join us as we look for a risk-averse way to ride the Brahma bull, click here for a free 7-day trial subscription that will give you access to all Rick’s Picks services, including a 24/7 chat room that draws traders from around the world.

Splitting hairs BDTR. Did you read my post? The trend for 9 months has been down. Nobody was even talking about 10 year charts. Try to keep up.

Seriously, you gold-people are sooooo touchy.