First things first, for those who don’t already receive these commentaries by e-mail: If you’d like to be entered in a weekly drawing to win a three-month subscription to Rick’s Picks worth $106, click here. What do paying subscribers get that lurkers don’t? Plenty. Yesterday, for instance, they were advised to cover half of a bullish position we’d staked out in GDXJ, a vehicle popular with the gold crowd that tracks junior mining stocks. We paid an average 1.85 for some August near-the-money call options, but because the stock has been strong this week, we were able to exit half of them yesterday for 2.25, a nickel off the high. The implied 40-cent profit has effectively reduced the costs basis of the calls we still hold to 1.45. Considering that the options have more than four months till expiration, odds of making a profit look pretty good.

Ordinarily, the odds are horrendous for retail customers who simply buy puts or calls based on hunches. How bad are the odds? If it’s a bearish hunch your playing, you’ve got a better chance of making money by matching three numbers on a lotto ticket. I’ve been trading options for nearly 40 years, twelve of them on an exchange floor, and have yet to meet a single person who has made money on put options over time. The odds aren’t much better for buy-and-hold call buyers, either. All options are “wasting assets” because their value decreases as their expiration date draws near. Because of this, options positions must be “worked” to produce a profit.

The Option ‘Sweet Spot’

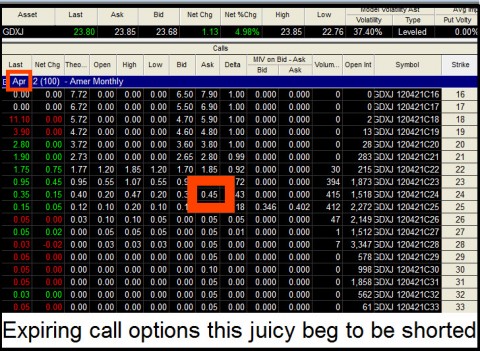

One way we might work our August call position is to sell other calls against it. For example, if the stock continues to rally, we might be able to sell August 25 calls for 0.45 apiece. That would give us a bullish “vertical calendar spread” on which it would be very difficult to lose money. The best outcome we could hope for would be for GDXJ, which settled yesterday at 23.80, to be trading just below 25 when the April options expire next Friday. We would simply pocket the 0.45 premium, further reducing the effective cost basis of our August calls to 1.00. Capturing the “juice” in an option that has just a week or two left is the sweet spot of option trading. Near-the-money options are typically at their most overvalued just before they die.

Ideally, we would repeat this tactic, shorting, in successive months, May calls, then Junes, and finally Julys. If GDXJ were to stagnate or move steadily higher between now and August, it’s conceivable that our “covered” (as opposed to naked) sales of soon-to-expire calls would more than offset the 1.85 we originally paid for the “Auggies”. In the meantime, our “edge” would have come, simply, from having bought the August calls at the right moment, when GDXJ was bottoming last week. Granted, there’s always a chance the stock could crash through the recent low. But it would have to fall pretty hard to turn our August calls into losers. With a little more work, though, we may be able to reduce their costs basis to less than zero, making a loss impossible. Subscribe and you’ll have an opportunity to come along for the ride. For seven days’ free access to all of our services, including detailed daily trading recommendations and a 24/7 chat room that draws traders from around the world, click here.

Don’t know much about options…

Can’t predict flash crashes…

What I can say is that I’ve been tracking the ratio between numismatic gold coins and spot, and we are back to prices on numismatics where spot gold was in the low $900’s. Miners are acting poorly. Somethin’s gotta give…