Without intending it, Rick’s Picks may have become an oasis for gold and silver bulls who are at the point of despair over the mining sector’s relentless, and presumably unjust, plunge. We have good news for you: Using technical tools to tweak your timing and risk management, it’s possible to buy “crap” stocks all the way down without getting hurt if you’re early. We use the word “crap” ironically, of course, since it is only when stocks have been beaten down as badly as those in the mining sector that they become screaming bargains. And that pretty much sums up the situation as far as we’re concerned. Not that the blighters who have been doing the selling couldn’t bludgeon bullion shares even lower before they relent. In the meantime, wouldn’t it be lovely to take all that stock from their undeserving hands — and to do so without penalty or punishment if we are premature?

On the subject of mining-sector “crap,” a perfect example is the execrated and abhorred GDXJ, an Exchange Traded Fund (ETF) that tracks the shares of junior gold mining companies. Although it has an ardent following among Rick’s Picks subscribers, GDXJ has unfortunately proven treacherous to the financial health of long-term investors. Some of them may have thought GDXJ looked like a great bargain a couple of months ago when it was trading for around $30 a share, down from a high of $43 in 2011. We told subscribers to hold off on buying, however, warning that the stock could eventually fall to $20 or even lower. That is still a possibility. Nonetheless, to avoid missing a possible long-term bottom, we started nibbling at 23.93, a “Hidden Pivot” target first advertised in the newsletter when GDXJ was still above $26. The buy at 23.93 proved timely when the stock, having gone no lower than 23.90 that day, surged to 25.79 – a 7 percent rally. With the stock steeply on the rise, we further advised subscribers to take partial profits to reduce position risk. And then we sat back and waited for GDXJ’s fabulous bull market to unfold.

It was not to be, however, and when GDXJ fell anew, we recommended exiting the position, still profitable on paper, at 23.59. And then we did it all over again, buying August 23 calls when the stock was hitting a new, targeted low at 22.74. The options cost us $1.80 apiece, but we were able to reduce their effective cost to 1.45 by selling half of them for a profit when GDXJ rallied to 23.85. Thereafter, it was “rinse and repeat”: With GDXJ shares getting schmeissed yet again yesterday, we exited the options on the opening for 1.50, booking a small profit on paper. And now, we plan to try again if and when the stock falls to our next downside target, 20.72.

Worth All the Work?

By now, you’re probably thinking this sounds very labor-intensive. It is, but it is still the best way we’ve found to take the sting – and most of the risk – out of buying assets that look like bargains on paper but which are nevertheless continuing to get savaged on a regular basis, however unjustified. This would be true of Silver Wheaton as well, another mining stock with which Rick’s Picks subscribers have had a longstanding love-hate relationship. We like the stock ourselves as a long-term play, but our enthusiasm will always be tempered by the coldly technical analysis for which Rick’s Picks is known. It led us to buy June 40-42 calls spreads a couple of months ago when the stock was carving out a promising bottom. Immediately thereafter, when SLW rallied as expected, we took sufficient partial profits to reduce the cost basis of our vertical bull spreads to zero. And a good thing, too; for despite Silver Wheaton’s atrocious performance ever since, we continue to hold a riskless, bullish position that causes us no concern. That’s not to say our spreads will produce a profit, however. That would require SLW to rally above $40 between now and mid-June, when the options expire. Most Silver bulls would have taken that bet back in early March, when we got on board near $34. But with the stock currently trading for around 28.34, it has become a 50-to-1 horse.

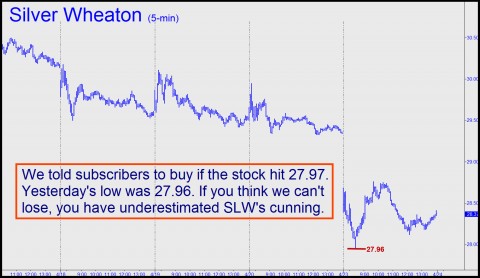

For the record, we told subscribers to buy more Silver Wheaton shares yesterday at 27.97, a Hidden Pivot correction target. Lo, the stock bottomed at exactly 27.96 (see chart above) after plummeting $1.38, or nearly 5 percent, in the first hour of the session. The trampoline bounce from within a penny of the target took SLW to 28.76 intraday. We were well on top of the move with an intraday bulletin telling subscribers to take a partial profit at around 28.66. This effectively reduced our cost basis for the shares to 27.47 – 50 cents beneath the pit-of-despair bottom achieved at the low. How can we lose, right?

We’ll see. In the meantime, Rick’s Picks will continue to do its utmost to help long-term bullion bulls precisely time mining-share purchases so as to avoid the pain and misery of buy-and-hold strategies. You can follow the process, and perhaps join in the fun, by taking a free subscription to Rick’s Picks with just a click of the mouse.

***

Win a Subscription Worth $106!

If you aren’t already receiving these commentaries by e-mail, sign up now and you’ll be automatically entered in a weekly drawing to win a three-month Rick’s Picks subscription worth $106. Click here to register. What do paying subscribers get that lurkers don’t? Plenty, including detailed daily trading “touts” and access to a 24/7 chat room that draws traders from around the world.

I’ve been seeing many of the same things, Robert, but over a period of years, not just recently. Mainly, it’s a case of large, phantom bids and offers fading even the smallest genuine bids and offers. This is not so much a function of high-speed (“algo”) trading, where bids and offers aren’t even displayed, but of neural-net arbing and hedge-trading by firms. Large bids or offers will usually trade only if an advantageous offset comes in serendipitously. “Size” bids and offers will occasionally be crossed, but I gather this is mostly firm traders front-running their own customers. That was one of the biggest sources of risk-free profits when I was an option market maker in the 1970s/80s, and I doubt the game has changed since.

The regulators are “looking into” high-speed trading, but merely doing so may obligate them to shut the whole business down, since there is no legitimate or even redeeming rationale for the practice.