[What themes will drive investment in the next decade? In the essay below, ‘Mercurious,’ a frequent contributor to the Rick’s Picks forum, sees the ebullient U.S. consumer as a dying breed. Even so, for investors who understand that consumption itself is not going to die but merely change, there is money to be made. RA]

As investors, we should be keen to discern changes in large-scale behaviors that will affect the what and when of our buys. The market ideally is a barometer of where we are in an increasingly interconnected world, and even factors like high frequency trading are usually just amplifiers of what is, rather than total distortions of it. When we survey the effects of ongoing world-wide financial and political distress, can we begin to see changes in the contours of how we think and what we buy? If we do, it would be prudent to take them into consideration and invest accordingly.

To begin, this is fundamentally a U.S.-centric analysis. While other areas of the world are rising fast in overall consumption spending and investing, the U.S. still leads that metric, and for the time being remains the dominant arbiter of popular culture. I think the feedback mechanism of instant communications is supporting the emergence of a world-wide cultural norm, so this is not just about the U.S. in the long run, but I’ll confine myself to the U.S. for now.

Some themes we would want to be aware of in orienting ourselves to the current domestic landscape would be: a flood of technological innovation, much of it focused on and available to the masses; a retreat/collapse in widespread employment of a level consistent with a middle-class lifestyle as we’ve come to know it; tremendous political ferment on both the left and the right; unprecedented levels of distrust in the large institutions of our culture such as corporations, government and religion; a rising tide of privacy invasion by government and business, with the concomitant problems of identity theft and sense of violation; a medical care model that offers mind-numbing costs married to patently inferior outcomes; numerous examples of small-scale innovation that outperforms lumbering corporate fixes; rage against the injustice and inequality of a system that richly rewards elite failure and hands the bill to the average American; a non-stop torrent of messages, advertising, propaganda, spin and entertainment/diversions to a nerve shattering level; a near-universal belief that the game is rigged in the markets and political arena such that true competition has been throttled and “you can’t win” against entrenched interests. There are subtexts to these ideas that are important, but this is a start.

The Post-Modern Consumer

If we were modeling a U.S. consumer under these conditions, what would we come up with? Someone in a state of high agitation with less and less commitment to all present large systems, struggling to make ends meet with no relief in site, lacking the characteristic American optimism of the past, more trusting of decentralized and small-scale approaches, and less able to withstand further financial shocks yet more vulnerable than ever to experiencing them. And then there’s the bad news.

Given these and similar underlying variables, is it reasonable to expect consumption patterns, political alignments and lifestyle choices to reflect the past? Hardly…but that’s not the question. Rather, how will these behaviors reshape themselves over time and how can we as investors arrive early and reap the benefits?

As a starting point, I would suggest we can look forward to increasing tension between what we want and what we have to pay for it, in both real and intangible terms. Americans are in the middle of a largely unconscious process of seeing the world reordered and our place in it diminished. Easy money is being replaced by tougher times with little relief in sight. We’re making choices, clipping coupons, cutting back, cutting out, rethinking the need for the many unnecessary “essentials” of textbook American life. This will have a profound effect not just on consumption patterns but on our national psyche, with consequences that are difficult to predict. But I think one outcome that’s assured is more of us will be voluntarily dropping out, in a consumptive and political sense.

Train to Nowheresville

There comes a time when the sheer overload of keeping up with it all becomes so unmanageable that we lose the desire to continue. Whether it’s the academic over-training that prepares master’s degree holders for a job as a rental car desk clerk, or the product cycle of many contemporary goodies rivaling the life of a mayfly, at some point many more will discover the value of not jumping aboard this train to Nowheresville. Even sheep eventually figure out when they’re in danger and will act accordingly. And we will, too.

Recent calls for closing accounts with large banks have resonated strongly, with credit union bank membership soaring. Open source computer applications are being offered to thwart the business models of megacorps that threaten our online privacy. Popular forms of shunning such as Change.org petitions can marshal hundreds of thousands of the like-minded in a matter of days, and have been instrumental in quickly melting adamantine positions that offended the popular sensibility. (When was the last time constituent letters to Congress had that effect?) Numerous alternative sources of information are being utilized with great effect as people learn there’s “the story” and there’s the truth. Hidden pivots or EF Hutton…your choice.

Big Change=Big Adaptation

As we scan the horizon, we might want to be especially aware of trends that are counter to the strongest dynamics we see today: conspicuous consumption, mass anything, lack of regard for basic goods/services that we take for granted. All it will take is a large enough subset of our culture to willingly adapt to our changed circumstances and de rigueur will morph to rigor mortis. It’s happening already. When I was twenty-something, living at home would have been my cohort’s second choice after entering a Cambodian re-education camp. But that same demographic today views it as a smart alternative, enabling them to maximize smaller discretionary incomes. Which brings me to my final point.

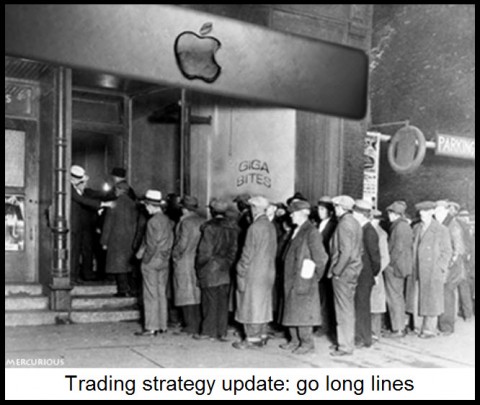

Anyone who takes a simple-minded contrarian position going forward will be surprised, I believe. If you expect cash strapped youth to give up their expensive smart phones and the accounts to service them, you might not like your investment results. As humans, we require certain artifacts be kept nearby to constantly remind ourselves of how great it is to be here. Ice cream consumption went way up in the Great Depression and I would expect iPhone market penetration to mirror that in our second Great Depression, taking into account both cost of living and ego inflation. But that may not be where the real money is to be made.

Food, energy supplies, clean water, secure societies in every sense: I would be looking in this direction for investments that would provide outsized performance for many years to come. There are a number of exciting and well-developed decentralized technologies that could revolutionize any one of these areas. The problems are not technology and finance, it has been their application to the trivial and destructive. As we move further into a future that rediscovers the importance of getting the basics right, I think we’ll emerge battered but better for the journey.

And one last thought: Water is the new silver.

***

(Mercurious is a technical writer and consultant for a mid-sized entity that seems to be structured after the Daily Planet model. He lives along the sunny Gulf Coast, is represented by Congressman Ron Paul (may his tribe increase), and enjoys a short bike ride to the beach and good books, always non-fiction. He believes we are in a paradigmatic phase change of world-wide proportions and is not at all sure how it will turn out. He considers himself lucky to be old enough to remember when songs described now as classic rock were first released and to have discovered silver at $4.70.)

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

It would appear, at first only, to speak of the same things you speak of. But not after a closer, more inquisitive look.

In general, taking links from patrick (if this is where you saw it) should be done with a freight train load of salt. He was simply beautiful on “why you should not buy house”. I too, thought at that time, that he is actually smart guy. Nope. He turned out to be pretty dumb, as you can tell by an absolute dominance of socialist propaganda on his page today, he just happen to have a good view on housing, as applicable to 2006 -2009 period. It doesn’t look as this was the case of a broken clock being right twice a day, but sadly, he was not right on anything else ever since.