[Many who receive my free commentaries each day and who visit the Rick’s Picks forum to share their thoughts are unfamiliar with the forecasts and trading recommendations that only paying subscribers get to see. I would strongly encourage ‘lurkers’ to try the service free for a week so that they might begin to appreciate the finer and more purposeful advice that lies behind the headlines. Click here and Webmaster Mike will set you up for next week. Then read the following, a response to a post by ‘Gary L’ suggesting that my permabear bias may be clouding my judgment about trades and investments. RA]

Gary, you haven’t taken the Hidden Pivot course, nor have you followed the detailed trading recommendations that I disseminate each day to paying subscribers, and so your impression of Rick’s Picks is likely to be based on the free commentary published daily at this site. However, and as any one of my subscribers would tell you, I focus obsessively on trading and forecasting strictly by-the-numbers. ‘Bullishness’ and ‘bearishness’ aside, for me and many ‘pivoteers,’ it all comes down to observing uptrending or downtrending impulse legs in different time frames.

This very simple idea guided me unfailingly during a time when I might otherwise have stumbled badly. In the weekly column I wrote for the San Francisco Sunday Examiner years ago, I dissed the dot-com boom as it played out, never deviating from the shrill warning that this remarkable eruption of greed and stupidity would take many investors down with it. The Examiner’s readers must have seen me as Chicken Little (until the crash, that is). However, at that same time, the customized daily forecasts that I was selling to groups of floor traders on the CBOE and PSE made even Merrill Lynch’s analysts look like pessimists. Moreover, Hidden Pivot analysis proved ideal for pinpointing swing highs and lows in the stocks that moved most violently, including JDSU, Qualcomm, Broadcom, AOL and Yahoo.

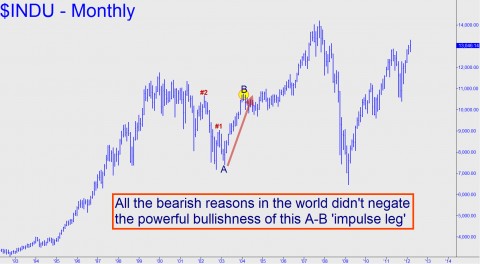

Some years later, in the summer of 2004, writing about the deflationary juggernaut that I believed (and still believe) will destroy the global financial system, the Dow was trading below 10,000, seemingly in the throes of a multiyear top. And yet, from a purely technical standpoint — the DJIA having created a bullish impulse leg on the daily chart six months earlier — I had to acknowledge that the blue chip average looked like it was developing thrust for a rally of more than 4000 points. That was extremely hard for me to believe, especially since the banking and housing disasters I had been predicting for years had yet to occur. Ultimately, I stuck with the charts and they never steered me wrong.

Even now, with a catastrophic credit collapse still looming and housing prices only halfway to the bottom I’d forecast more than ten years ago, my daily numbers for the broad averages have been finely in-synch with each new upthrust. And although, like every permabear, I have a jones for trying to catch the Mother of All Tops with a perfectly timed short, and for playing chicken with the bullish herd, I continue to attempt these feats — most recently with a 1412.75 short recommendation in the E-Mini S&P — only in ways that would subject subscribers to minimal risk. (In fact, most of these “failed” shorts have made a profit on paper, although the most recent of them looks unlikely to trigger because the so-far high fell a few points shy of my rally target.)

Gary responded by asking, “If you were of the opinion that the economic conditions are ripe for a huge rally this year how different would your calls be? Would you for instance stay away from bearish setups and concentrate on technicals that indicate a possible large move higher?”

My reply:

“Most of those who frequent this forum do not share your view that ‘economic conditions are ripe” for a big rally. To the contrary, we believe the economy is so deeply and dreadfully sick that only a financial collapse can set it back on a path to health. I gather that you agree, even if you doubt that the collapse is imminent.

“At a more fundamental level, we apparently disagree over whether ‘the economy’ and the stock market are even connected. If so, it would seem that the relationship is neither rational nor predictable. What seems most obvious, if not to say indisputable, is that stocks have been responding to an unprecedented, global surge in credit money. In point of fact, nearly all of it, including a derivatives market with a notional value estimated at just under a quadrillion dollars, is wholly imagined. It could vanish in an instant — and inevitably will.

“In the meantime, we shouldn’t kid ourselves about the wisdom or value of trading on ‘fundamentals,’ since they are rooted in statistical legerdemain and subject to wildy exaggerated interpretation by Wall Street’s permabullish sales force. Charts, on the other hand, have the singular virtue of reflecting only what is.”

***

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

As if things are not manic enough in the stock markets, a CA couple offered to trade their $29 M home for pre-IPO FB shares…