Lurkers sometimes come into this forum to take potshots at my forecasts, evidently unaware that the techncial analysis they might find in my commentaries is often less precise, timely and finely nuanced than that which paying subscribers receive every day. One such lurker was ‘Steve,’ who culled an $18.355 target for March Silver from a list of “Predictions for 2012” I’d published early in the New Year. Steve questioned how this very bearish forecast could differ so dramatically from a $30.35 target featured shortly thereafter in the Touts section and in this forum. Because Steve himself blogs professionally (I gather) on the subject of Silver, one might infer that he had an ulterior motive for bashing my forecast. Whatever the case, I have reprinted his comments and my response below so that lurkers can better understand what they are missing by not paying for the good stuff that subscribers receive daily. (Click here to access the original discussion, or to add to it.)

Steve’s post:

Rick, I had a few questions. I recently wrote [an article] where I discuss that the majority of analysis on the Internet is contradictory and frustrating. I have been following your articles for some time.

I remember you DEC 30, 2011 TEN PREDICTIONS for 2012. Here was one of them:

Gold will stage a powerful rally after bottoming at $1445 in January, but the buying spree will fall well short of $2000. Silver will fare relatively worse, falling to $18.35 before finding traction and recovering into the low $30s.

——————————————————–

A little more than a month ago you were predicting $18.35 silver in JAN. Today, in your most recent article, you are now seeing “AN EASY MOVE TO $35.53″.

What I would like to know is this. How on earth can you have that much of a change in price in one month? It reminds me of what CLIVE MAUND forecasted back on JAN 8, when he said silver would go down to $18 in his charts.

Listen, I am not trying to be negative here, I just want to know how does JOE BAG OF DONUTS make any sense of the market when you make such an EXTREME difference in your price forecast within a month?

And my response:

It was brazen of you to come into my forum to launch this presumptuous, self-serving attack. But to those who have actually followed my forecasts closely over the years, you have only made an ass of yourself. While you were licking your chops over the prospect of taking me to task over an 18.355 Silver target that you lifted out of context from my here-goes-nothing ‘Predictions for 2012,’ below are the actual, verbatim forecasts that went out to my subscribers.

Have a chart handy, and pay close attention to the Hidden Pivot numbers (updated in real time, 24/7, by the way) as my subscribers most surely do, since these pivots are the fine details on which they would have based their trading decisions while you were gloating over my 18.355 ‘error’.

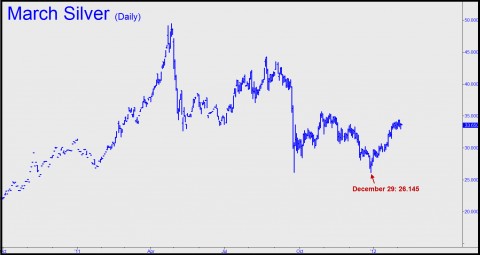

Taken together, the sequence of predictions below supports my assertion that if my forecasts are going to be wrong, it will not be by much or for long. I have boldfaced a portion of the silver ‘Tout’ published on December 29 because it could not have foreseen more accurately or in more timely fashion the major, bullish reversal that was to occur that very day. For in fact, the futures trampolined powerfully from a low that lay just four cents beneath the 26.185 support flagged in my analysis. They never looked back — and neither did I. As the record clearly shows, I gave my subscribers a bullish heads-up within an inch of the December 29 bottom. Thereafter, all of my highly detailed trading “Touts” were from the long side — albeit cautiously at first for reasons that I make explicitly clear.

December 29:

Yesterday’s selloff made short work of an ostensibly solid Hidden Pivot midpoint support at 27.018 pivot, lending authority to its 18.355 sibling. A 50% fall from here is not yet a done deal, although the futures are almost certain, at the very least, to breach late September’s 26.185 low before they find traction. It could prove fleeting, but I would expect a bounce of at least $4 over a period of 3-5 days if bulls are to be given a fighting chance. Keep in mind that the bounce would be occurring with relatively few profit-takers aboard, since most bulls will have gotten shaken loose by the feint beneath 26.185. If this rally were to fail to generate a bullish impulse leg on the daily chart (a feat that would require an unbroken sprint from 29.135 to 33.305), then we should prepare for the worst.

January 3:

Like gold, silver has begun the New Year with an unimpressive rally — up 25 cents at the moment. The thrust would need to tack on an additional 63 cents to turn the hourly chart bullish, since that’s what it would take to breach an ‘external’ peak at 28.790 recorded last Wednesday on the way down.

January 4:

Unlike February Gold, this vehicle is within easy distance of negating a target 40 cents below the recent bottom at 26.145. However, a much lower target at 18.355 is still in play, and we also need to take into account that the rally so far is not especially impressive considering that it was catalyzed by a viciously false breakdown beneath September’s neon low, 26.185. On balance, we can trade the minor rallies but use tight stops. Just such an opportunity could unfold Tuesday night or Wednesday based on the pattern shown. The implied entry risk would be $1500 per contract on the 120-min chart (25% of A-B x $50/1 cent), so you’ll need to zoom down to a chart (end entry pattern) of lesser degree when the big-pattern ‘X’ is about to trigger. _______ UPDATE (3:11 a.m. EST): A pattern very similar to the one I sketched triggered a 29.410 ‘X’ entry signal at around 2:10 a.m., but executing the trade on the 1-minute chart would have produced an unacceptably large loss of 2.5 cents per contract, or $125. Entry would have come off the pattern A=29.400 (2:47 a.m.); B=29.465 (2:48 a.m.), C=29.435 and X=29.455. A lower, second point ‘C’ at 29.420 (2:53 a.m.) yielded a solid winner that would still be live, but strictly speaking, ‘camo’ trades should work on the first try or we don’t do them. The next valid entry opportunity — and winning trade — would have come at X=29.495 (3:00 a.m.), but I’ll let you discover the details so that you can learn from them. (Swimming with the sharks in the wee hours needn’t be scary. If you’re a night owl looking to make the most of the excellent opportunities that frequently occur when most traders are asleep, click here.)

January 5:

Unlike gold, silver’s thrusts have been unambiguously impulsive on the lesser charts, suggesting it will lead the way (as well it should, since silver has a lot more lost ground to make up from 2011). We can use the 30.120 Hidden Pivot shown in the chart as a minimum upside target for now, predicated on a decisive push above it ‘p’ sibling at 29.520. That resistance was exceeded yesterday by 2.5 cents, tipping my bias for Thursday bullish. Night owls should notice that, at press time, the futures were working on a bullish ‘camo’ pattern projecting to 29.600. On the 15-minute chart, A=29.120 at 8:30 p.m. EST, and B=29.440.

January 6:

I identified a Hidden Pivot at 30.120 here yesterday as a minimum upside objective, but yesterday’s price action lends more weight to another pair of pivots — they lie, respectively, at 29.755 and 30.825 — that will probably play a larger role over the next few days. The provenance of both is shown in the chart, and it will undoubtedly take some diligent attention to the 15-minute chart to exploit the anticipated move without risking much.

January 9:

March Silver spent the week backing and filling following the 14% rally that has kicked off the New Year. Remaining patient is our only option at the moment, but we can still use the 30.215 ‘external’ peak shown in the chart to tell us when mere noise is starting to sound more like the fearsome snort of a resurgent bull. Camo traders should stick with micro-risk plays on the 5-minute chart, since this vehicle has been creating new point ‘C’ lows as though every silver trade out there is all too eager to buy. (Want to learn how we use Hidden Pivots and “camouflage” to reduce entry risk to relatively small change? Click here.)

January 10:

Yesterday’s peak at 29.205 created a bullish impulse leg on the hourly chart — and a bit of camouflage as well. The pattern is shown in the accompanying chart, with a buy signal at 28.875 that would have implied far too much entry risk — $900 in theory — for us to have used bars of hourly degree. (Pop quiz for camouflageurs: Can you find a better, cheaper way in on the five-minute chart?) Because the 29.000 midpoint pivot has been exceeded to the upside, we should infer that the pattern will complete to its ‘D’ target at 29.250. If not, bulls are more enfeebled at the moment than we might otherwise have suspected.

January 11:

Silver would have to rally a further $5.50, exceeding 35.680, to negate the scary targets below $20 broached here earlier, but the $4 rally so far is an encouraging start. It projects to at least 31.030, but if that Hidden Pivot fails to slow buyers down, we’d be looking at a possible rampage to as high as 32.145. To assess buyers’ resolve, we should pay close attention to the ‘external’ peak at 31.070 that was recorded in mid-December in the throes of a steep fall. If buyers pay it little heed, that would be the most heartening technical sign we’ve had since October, when the futures embarked on a 12% rally that ultimately failed.

January 12:

The 31.030 rally target given here yesterday continues to serve as a minimum objective for the near term, but a close above it would augur more upside over the near term to as high as 32.145. The effort so far this week has created a bullish impulse leg on the daily chart by surpassing an ‘internal’ peak at 29.740 recorded last Wednesday and an external at 30.210 from December 21, implying that any pullback that doesn’t breach 29.210 to the downside would be setting up another rally leg. More immediately, night owls can use the pattern shown to try to get long. The entry signal has already been tripped at 29.930 on the ‘15′, so you’ll need to drill down to the ‘5′ to get aboard belatedly.

January 13:

March Silver went impulsively bullish on the lesser charts late Thursday night, but this was after it achieved a ‘D’ target on a pullback. That suggests bulls will struggle on Friday and that any trades from the long side be done via a ‘camouflage’ entry that poses no more than $70 of theoretical risk per contract. At exactly 1 a.m. EST, the three-minute chart showed an ‘camo’ pattern with a potential entry trigger at 29.985. The coordinates are as follows: A=29.875, B=30.010, C=29.950 (Note: That last number is very tentative). This set-up may be gone in five minutes, but I have presented it nonetheless so that you’ll have an idea of what to look for if you want to get aboard tonight using charts of least-most degree.