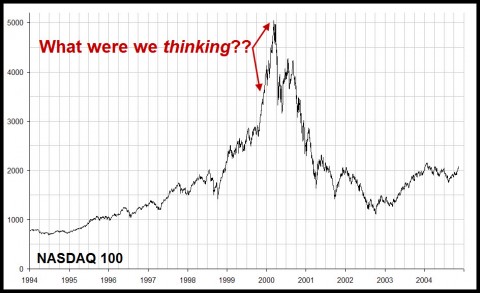

[We wrote the following column for the Sunday San Francisco Examiner a month before the dot-com bubble burst in March 2000. Overnight zillionaires were a dime a dozen back then because countless investors couldn’t wait to pay practically anything for the shares of unproven companies. Nowadays, billion-dollar scores on Wall Street are much rarer, but as the lucrative IPOs last year for LinkedIn and a few other purveyors of Vaporware II demonstrated, enough greed and stupidity still remain to make canny stock-promoters rich. RA]

It’s said we are separated from the rich, the powerful and the famous by a chain of no more than six friends of friends. This means that if you are looking for a job in the White House, or a way to meet Winona Ryder, it should take no more than half-a-dozen phone calls to get in the door. But I’m beginning to wonder whether it would take even that many calls, on average, to reach a friend of a friend with eight-figure net worth. There seem to be so many of them around these days. More than lottery jackpot winners, as far as I can tell. Although I personally know a dozen guys who have reaped spectacular riches from stocks in the last few years, I’ve only known one big-time lottery winner in my life — “Bunky” W., who wrestled heavyweight for Atlantic City High School in 1967.

Bunky hit the New Jersey lottery for $1 million, which made him a celebrity at our thirtieth reunion, held at Trump’s Casino in the summer of 1997. But these days, with Wall Street’s IPO boom sprouting megamillionaires like dandelions in May, a story like Bunky’s would barely raise an eyebrow at the next reunion. Arthur’s would, though. He is a childhood friend and among the brightest students in our graduating class of about 700. In physics and math, he always had the answer on his slide rule before the rest of us had even parsed the question. Arthur breezed through MIT and took a job with a company whose forte was designing equipment to detect the presence of black holes in outer space.

He shifted into entrepreneurial mode in the 1980s with the invention of a computer language that supposedly was going to revolutionize the way machines talked to each other. Perhaps the venture would have made him rich if he’d possessed Bill Gates’ flair for marketing — seasoned, perhaps, with just a touch of Gatesian ruthlessness. However, he had neither quality, and that is probably why his software never even made it to the shelves. That may have been a stroke of luck, since it would have occurred a decade before investors went into hyperdrive a few years ago, in their seemingly boundless zeal for hot new ideas. Worse still, the product might have gone head to head in its infancy with one of Microsoft’s. Instead, Arthur kicked around for a few years in the software business before joining a Boston-area startup a few years ago that has since pushed his net worth into the big leagues.

Insider Stock Worth $500M

The company sells software and services that help businesses manage their own software on the Internet. Investors took to the idea in a big way. The company went public last August at $16 a share, but within a few months it was bid up as high as $131. Arthur’s 550,000 shares of insider stock made him worth a tad more than $72 million at that point. If it were just one man’s riches, that would be quite a story. But Arthur isn’t even the biggest fish at the company: there are four others above him in the firm’s hierarchy.

Assuming each has at least half a million shares of insider stock, that translates into a lot of money. More, even, than the half-dozen or so biggest lottery winners of all time have taken home. Over that time, I can recall reading about only a few people in America who have won jackpots exceeding thirty or forty million dollars. But here we have just one company in Boston where five people standing around the water cooler made $500 million on paper in the space of just a few months.

As we know from the business pages, there are companies like his all over America, each with a bunch of VPs, CTOs and CIOs who have grown fabulously rich on insider shares. Richer, even, than lottery jackpot winners. Where is all that money coming from? There can only be one answer: From the pockets of millions of investors, all eager to share in the bounty of a bull market that has created more than $8 trillion of paper wealth in just the last few years. It is pretty well spread around, too. Even before some key stock averages went vertical in late 1998, there were more than three million U.S. households with liquid net worth exceeding $1million. Now the number is over 4 million, with about 400,000 in the $5 million category and 60,000 worth at least $10 million.

Small wonder, then, that the IPO business is so hot, or that there are hundreds of new companies in the U.S. where a few employees standing around the water cooler could be collectively worth half a billion dollars. Corporate insiders are hitting much bigger jackpots than Lotto winners, and much more often. The statistics tell us why: For every 10,000 pikers who can throw a buck or two at the lottery each week, there are a hundred millionaires ready to sink $50,000 apiece into some hot new IPO.

***

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

There doesn’t seem to be any company that went public last August (2011) at $16 a share. Other than “Arthur,” are the other details also intended to obfuscate the facts?

The closest possibility for an August 2011 tech IPO would be Carbonite Inc., which is Boston-based, but its share price never went anywhere near $131.