If DaBoyz can squeeze a 500-point Dow rally out of yesterday’s administered easing of dollar “swap” rates, just imagine what they can do with a little Santa seasonality and a dollop of year-end window-dressing. Let’s be straight about a couple of things. First, no one expects the latest easing of global credit lines to resolve Europe’s debt crisis. And second, the 800 points the Dow has tacked on this week represent little more than trading machines masturbating each other amidst a short-covering panic. Some observers merely yawned, noting that the swap arrangements that make it easy and cheap – and now even easier and cheaper, if such a thing were imaginable — for foreign banks to borrow dollars have been in place since 2007. However, others saw the announcement by the central banks as nothing less than a bold step by the Federal Reserve to begin monetizing the debt of Spain, Italy, Greece, France et al.

It’s a moot point whether the U.S. has begun bailing out Euro-deadbeats, however, since the U.S. is a deadbeat itself, albeit one in sole possession of the world’s reserve currency and therefore of the ability to gin up unlimited quantities of the stuff at will. Meanwhile, there’s little point in pretending that the U.S. is somehow not immersed in the bubbling cauldron of toxic global finance. U.S. banks had stopped lending to their European counterparts, and that’s why the Fed stepped in to pretend it has the situation under control. This may work for another week or so, if that long, but it’ll be interesting to see whether reducing swap rates to near-zero will help suppress sovereign borrowing rates that recently topped the 7% “red zone” for Italy. Would you lend the Italian government hundreds of billions of dollars at 7%? That’s what we thought. But if you live in Europe or the U.S., you’ll be doing it anyway – and for a lot less than 7% –courtesy of the bankers.

A Hyperinflationary Step?

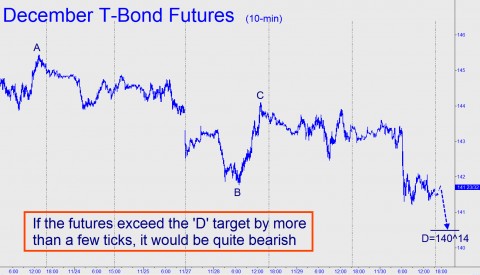

Not to spoil the party, but we’d suggest keeping a close eye on T-Bond futures rather than on a criminally insane Dow Industrial Average that has obviously run amok. U.S. Bonds and Notes have been in a sharp correction, with the former closing on a key Hidden Pivot target of ours at 140^14. The target is so clear and compelling that its breach would offer strong evidence that the Fed’s increasingly desperate attempts to hold deflation at bay are about to finish the dollar’s destruction since the Fed was created nearly 100 years ago. We’re planning on bottom-fishing near the target (click here to join us – at no cost to you), but if it the “hidden support” is exceeded even slightly, it could be signaling a significant global increase in inflationary pressures.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

This deflation/inflation crap talk is stupid…gold and silver for 10 years what their sniffing out and thats with massive price suppression.TRo say we might head into global inflationary circumstances is like saying i took a knife and cut my arm and if i dont intervene i may bleed to death or @ the very least injure my arm.Chris Powell of GATA has said for years….THERE ARE NO LONGER MARKETS ONLY INTERVENTIONS!!!!its great for newsletter sales and talk but deflation would always be defended by the criminal cabal.