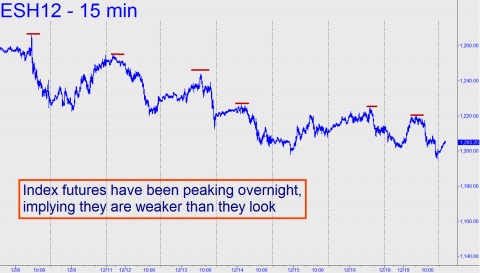

It’s getting a bit late for a Santa rally, but you can’t blame DaBoyz for trying – trying every night, actually, after most U.S. traders have gone to bed and there are almost no sellers to resist the stock market’s natural buoyancy in a time of unprecedented monetary easing. We’ve lost track of how many times in the last month index futures hit their highs in the wee hours, only to fall into the red during the regular trading session. It happened yet again Sunday night when the E-Mini S&Ps wafted the equivalent of 90 Dow points higher on volume-less trading before dropping sharply to close off a hundred points.

We’d held a long position in the March futures going into the weekend, and although the position showed a paper gain of $600 when we exited on a stop at 1210.75 Monday morning, we bailed out well off the overnight highs. This wouldn’t be the first time we got long with an ultra tight stop-loss using the Hidden Pivot “camouflage” technique, nor would it be the first time that the uptrend we boarded went nowhere. Catching the occasional big wave is always our intention when we do “camo” trades, but given the choppy, go-nowhere, do-nothing price action in recent months, we’ve had to adjust our “long-term” horizon downward not to months, weeks, or days, but to hours.

Santa’s Influence Nil

Concerning Santa’s seasonal influence on Wall Street’s otherwise pointless, algorithm-driven histrionics, news from Europe has overshadowed so-so reports on holiday retail sales in the U.S. The last such report suggested that many shoppers had finished early this year and that there would not be much good news coming down the home stretch. Such “facts” seem impossible to determine, though, since it would require exit polls at the malls to say whether shoppers are indeed spent out. We’ve seen no such pollsters ourselves during recent visits to Colorado’s Flatiron Mall, but neither have we seen crowds of buyers. Our gut feeling is that the holiday will be a mild bust for stores, or perhaps worse, and that’s one reason we bought some QQQ put spreads at the January strike. You can follow the position by taking a free trial subscription to Rick’s Picks. This will not only give you access to actionable trading “touts” each day, but also entry to a 24/7 chat room that draws experienced traders from all over the world.

***

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

I think you made DaBoyz mad Rick. Their out to prove you wrong… even if only for a day.