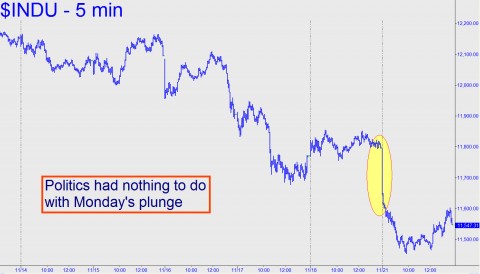

We view yesterday’s stock-market plunge as unrelated to the failure of the not-so-Supercommittee to compromise on a paltry $1.2 trillion in budget cuts over ten years. No one expected a deal in the first place, and even if there had been one, its effect on the economy, let alone on the deficit, would have been negligible. Who would ever have believed even a decade ago that a “mere” trillion dollars in Federal outlays would hardly be worth arguing about? Still, the way stocks fell, one might have inferred investors actually cared about the outcome. The nightly news pretended it mattered, perhaps because there were no titillating alternatives to serve up on a slow-news day. Wall Street did its patriotic bit as well, feigning concern by sending the Dow Industrials 250 points lower. In fact, there was bound to be a little knee-jerk selling by institutional traders fearful that their competitors would be selling “on the news.” In our view, markets are driven higher, lower, and sometimes nowhere by mysterious cyclical forces that we will never quite understand. Moreover, it is the cyclically driven price swings that color our perceptions of the news, not the other way around.

Trumped-up headlines aside, one thing likely to send a wave of genuine fear through Wall Street is the impending failure of Europe’s deadbeats to get Germany to bail them out. And, make no mistake, it is only Germany that could be imagined big enough to pass itself off as a credible savior for all of Europe. France is usually treated as Germany’s co-equal in bailout discussions, but in fact France is not a significantly better credit risk than Italy or Spain at this point. Under the circumstances, the unelected bureaucrats who purport to manage Europe’s affairs are hoping to gain support for a eurobond that would be seen as spreading the risk of a default across many nations. Since most of those nations are financial basket cases, however, it is only the mountebanks and Ponzi operators who run the political institutions and banks who could even pretend such a strategy will work.

Germany’s Decision

What we should expect instead is for Germany to veto any thinly disguised attempt to paper over Europe’s debt problems, American-style, with two or three trillion euros worth of new eurodebt – debt that presumably would be “purchased” by a bankrupt banking system. The decision would have grave implications for the German economy, since it would create a two-tiered currency system in which “bad” money would circulate in the deadbeat countries while hard currency – presumably euros – would remain the unit of exchange for Germany and a few other sovereignties still viewed as solvent. Having to sell Mercedes Benzes and Siemens machinery in hard money would put enormous strain on the otherwise robust German economy, probably sending it into recession. Still, if forced to choose between Belgium’s quack remedy and one that would allow the default chips to fall where they may, we predict the Germans will opt for the painful solution that alone will allow the financial system to right itself.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

The financial system is collapsing,regardless of whether you are an inflationist or deflationist.if deflation.fed will print.Note IMF is funded 70 percent by FED.They increased credit lines to europe through IMF.If inflation ,FED will stop it as we will default if we dont buy treasuries /dollars to reduce interest rates or we default.KISS principle,buy physical sipver not gold as they may steal gold from you.AG is the trade of this decade as per Eric Sprott.!!!!!!Its simple as negative REAL INTEREST RATES ARE ALWAYS BULLISH for gold and silver.You all talk so much with ego and bull crap but simplicity is elegance.Buy phys. AG and ho;d for 5 years and live life, love life and give to life and i promise you will be a better person and wealthier