Something really does stink on Wall Street, and so, like nearly every other trader we know, we’re itching to get short up the old wazoo. And while we would never do so expecting to nail the Mother of All Bear Rally Tops, we’re content to find juicy, perfectly tradable highs at least once or twice a week. Yesterday, for instance, the E-Mini S&P stalled for four hours precisely where we’d predicted, at 1351.75. Here’s the forecast exactly as it went out to subscribers the night before, when the mini-futures contract was developing thrust from around 1343.00. Keep in mind that we’d partially covered a short earlier in the day for a theoretical profit and were looking to do it again on the very next thrust: “Shorts initiated yesterday from near 1345.00 should be tied to a 1349.75 stop-loss. That is somewhat lower than the 1355.25 stop suggested here earlier, but it is also where the five-minute chart would now become menacing. Please note that the lesser charts are already working on a minor, bullish impulse leg that yields a 1351.75 target and a midpoint at 1347.00.”

Imagine what a cheap thrill it was for us to see E-Mini buyers stymied at exactly 1351.75 for most of the day. With any luck, one of these times we’ll be able to get short, and to stay short, for the rest of the decade. For now, though, our goal is to “go away in May,” but with a position that will keep on giving through, oh, the Fourth of July. But the real trick is to make money even when we are wrong. If you’d like to find out how successful we’ve been at this, or how much fun we’ve had, even when unsuccessful, then by all means ask a Rick’s Picks subscriber yourself. You can gain entry to our 24/7 chat room by taking a free trial subscription for a week. You might even catch one of our regular “impromptu webinars,” wherein we look for actual trades in bullion and index futures in real time. And although “THE” top has eluded all of us permabears for the last 26 months, nailing minor, shortable peaks with the Hidden Pivot Method is less difficult than it might sound. Of course, the pullbacks from such rally targets are frequently over before one has time to pat oneself on the back, but we’ve been able to compensate by taking partial profits readily whenever such trades go our way. We expect the task to grow easier in the weeks and months ahead, however, since seasonality will be heavily on the side of bears.

Chuck’s Turned Cautious

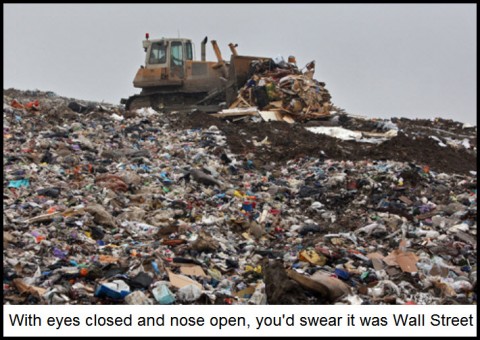

There are other factors as well that bears could cite. Our good friend Chuck Cohen, a NYC-based gold consultant and mining stock-picker, thinks the weak performance of financial shares, particularly Bank of America, is warning of a major stock-market selloff. BofA has fallen from $20 to $12 in the last year during a supposed economic recovery. If the stock looks that bad during relatively good times, where will it be trading when the inevitable economic downturn hits full-bore? For Chuck, the question is existential – not only for BofA, but for Goldman, JP Morgan and all of the others, since a run on BofA could push the financial system over the edge once again. Chuck says the stock market’s plunge would likely be simultaneous with a powerful rally in the dollar that takes the air out of commodities. Because of this, he has has turned unusually cautious on bullion, even while conceding that the price of gold could conceviably double at any time. He is particularly wary of junior mining stocks, which have barely budged even on days when quotes for physical were soaring. Like us, Chuck can barely stand the stench of this market. What will it be like in the heat of summer?

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Martin Armstrong calling for a TOP in mid-June.