End-of-summer travel delayed this report on Premium Exploration (TSX symbol: PEM) by a week, although we did issue an informal “buy” recommendation on the junior miner in the Rick’s Picks chat room a couple of weeks ago. The Canadian-listed stock was trading for around 45 cents a share at the time but has since moved up as high as 57 cents, where it closed yesterday. Based on technical analysis, we’re projecting upside potential over the near term to 64 cents, or perhaps 67 cents if any higher. These projections have a horizon of about 2-3 weeks, but there are longer-term forces at work that augur still higher prices.

Stock charts aside, we rate Premium’s shares a high-potential speculative bet for the long-term. The company is well managed under CEO Del Steiner, and its Idaho site has yielded some very

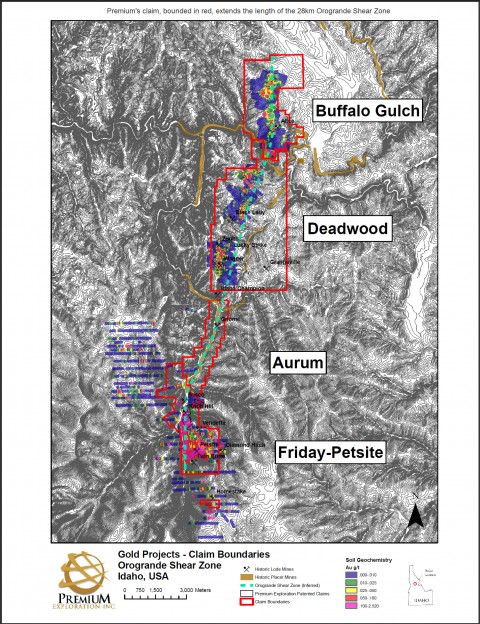

impressive core samples so far: 5.75 grams per metric tonne (g/t) over 76 meters, 3.65 g/t over 74 meters, and more than 9 g/t over 25 meters. Moreover, the larger structure from which these samples were taken is mostly unexplored. The Central Idaho gold region has already produced more than four million ounces of gold from mostly placer projects, but Premium’s site could conceivably double that figure over time. One reason investors are especially excited about the Orogrande fault zone is that it is geologically similar to Nevada’s Carlin Trend, which has produced more gold than any other mining district in the U.S.

Spreading the Word

We toured Premium’s central Idaho site on August 25 as guests of the company in an entourage that included such seasoned veterans of the precious metals world as radio host Al Korelin, Roger Wiegand, Sean Brodrick, Marshall Berol and Dan Pisenti. All came away sufficiently impressed by Premium’s operations, most particularly at Friday-Petsite, to have bought shares in the company immediately after the tour or to have taken back favorable reports to their respective investment firms. For the record, your editor holds no shares in the firm at present but plans to take a stake after this report has aired publically.

Premium’s financial position looks solid, buttressed as it is by a $10 million round of financing completed in July. This will allow the firm to undertake another 30,000 feet of drilling over the next two years. A 50 million-share float and warrants at 35 cents have damped down price volatility on news, but shares appear to be well covered by inferred resources including 549,000 ounces at Friday-Petsite.

For additional details, as well as a fascinating interview with CEO Steiner, I recommend checking out Sean Brodrick’s in-depth report on the trip at “UncommonWisdomDaily.” You can also find extensive site maps and detailed drilling results at Premium’s web site. As always, let the buyer beware. Due diligence is advised if you’re thinking about acquiring PEM shares.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box.)

Ben,

you have some legitimate questions about mining shares, and I would have no answer, only more questions.

But, I do think that you are asking the 2nd/3rd base questions, those pertaining to when you already have shares.

Personally, I can see plenty of reasons to by the miners, one only has to look at their charts medium/long term.

BUT, which ones?

How are people like us supposed to select between any of these shares?

Other than the HUI-shares and maybe XAU, how can we peons with day-jobs ever get the information to decide?

Rick is surely right about doing the do diligence, but that is an impossible task for us. At most we might get all the available company declarations, and srutinise. But as to any of that paper’s veracity, how could we ever know?

There is almost no point in even starting that D.D.

Not being one who can intra-day trade/day-to-day trade for simple lack of time, I have not considered signing up for Ricks H-P newletter.

If that information could be used for people like me,

and without derivatives, perhaps, but that does not seem the case unfortunately.

And even the H-P method would say nothing about these juniors, or rather, it only addresses price movements that reflect what those more informed than us believe about that company.

Surely good for H-P based day-trading, but that a price/price pattern determined by those well informed can turn out to be based only on generelly believed misinformation was proven by Madoff.

So the only thing left is to find out about these stocks from direct comments by others, such as Rick here, and then to either take that or leave it.

From what I have read here for some time, I would not feel greatly uncomfortable about a “recommendation” of this kind, speculative as it is in general, but as to doing anything more than that, impossible.

That’s why I have never put my cents in the ring for the shares, much as I would have liked.

Now if only there were a way to buy the HUI… (yes I do know about the miner’s ETF).