We wrote here the other day that once the bailouts and misguided stimulus attempts fail, the U.S. will have to start from the ground up to rebuild the economy. “But what mechanism can be used to bring back all the manufacturing jobs lost to China, Mexico, Taiwan over the last twenty years?” a reader asked in the forum. “It seems 80 percent of the population wants common-sense solutions, but the political meat grinder has its own agenda.” We replied as follows:

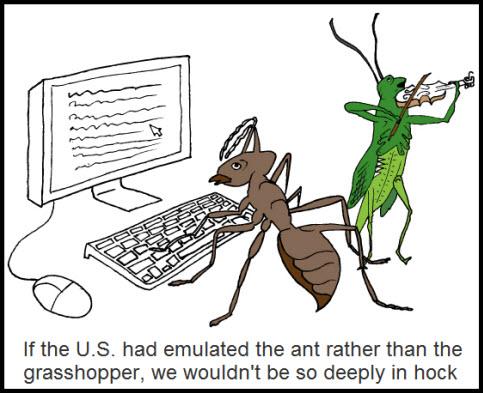

We’ll need to find our way back by producing services and goods that yield a comparative advantage for U.S. labor globally. That advantage would exist today if, since World War II, we had saved and invested most of our capital rather than consumed it and gone deeply into debt to live beyond our means. With Japanese levels of savings and investment, U.S. manufacture of steel, cars, clothing and such would be competitive with the most efficient producers in Asia and Latin America, much as our ability to grow and process corn — a business that has received huge investment — has remained competitive with the lowest-cost producers in the world.

Two economic factors suggest it’s going to be a very long road back — not mere years, but decades. First, we’ll need to discharge our current debts, whether through inflation or deflation, so that we can begin to accumulate savings once again. It is pointless to talk of the existence of U.S. household savings when they are dwarfed by much larger fiancial liabilities now on the books. The liabilities include, most signficantly, Social Security and Medicare programs that have been run as Ponzi schemes. Both will continue to rack up future costs that have grown almost beyond reckoning. To get on sound financial footing, we will also need to gut overly generous pension and healthcare plans at all levels of government, since they are on track to bankrupt the nation one city, county and state at a time.

Screwing Creditors

Since it is far more likely that hyperinflation rather than deflation (i.e., bankruptcies and forced liquidations) will be used to wipe out our debts, we shouldn’t count on the rest of the world, particularly a resurgent Asia, to eagerly lend us the money to rebuild. Even if foreign lenders should forgive us the screwing we’re about to give them and significantly underwrite America’s comeback attempt, their loans are unlikely to come with Marshall Plan forgiveness, meaning that a substantial portion of any wealth that grows from such investments will necessarily be exported back to their source.

If we get lucky, Yankee know-how could help shorten the time it will take for Americans to enjoy genuine prosperity once again without having to go deeply into hock. We could conceivably solve the world’s energy problems with a radical new source of power, such as cold fusion. Or we could achieve breatkthroughs in health care that would revolutionize the way the world treats the sick. Innovation and risk-taking have always been America’s strong suit, and our ability to raise capital to launch promising new ideas is still unmatched by any other country in the world. But will the politicians have the guts to change the tax code so that capital investment and resarch are favored over residential real estate? It’s hard to be optimistic about this, given the heavy skew of bailout incentives so far toward the goal of artificially propping housing demand and pumping up a banking system whose chief business is still financial speculation. It’s quite possible that only a deep crisis — i.e., a Second Great Depression — can force the changes needed to make America’s economy robustly competitive once again.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Bruce is right

But the only way people will stop buying imported goods or products (including oil )or goods assembled here from imported parts or materials is to impose BIG tariffs and use the revenue to fund goverment and generate cash for rebuilding manufacturing. higher prices for fereign goods will force domestic manufacturing to rebuild. Allthe good things like saving , education,health care etc. will react to this.

The rest of the the world will not like this since their industry will be hurt but if we don’t there won’tbe any markets left for any of their good here.

Simple but this must be done now. impose tariffs and watch the contry start to unwind th death spiral..