While Rick’s Picks has focused with bland, mechanical detachment on the technical picture in gold and silver, we rely on our friend Chuck Cohen, a New York-based gold consultant, to stir readers’ imaginations when they think about how high gold shares and bullion could eventually go. We asked Chuck for his current thoughts, and he kindly obliged, even though he was ensconced in a hammock in Puerto Vallarta, sipping a margarita, when we called.

** The single most important point remains that you keep your perspective fixed on the long-term picture. In spite of all of the monetary stimulation and frantic attempts to prop up a decaying system, the economy and the financial structure are still a mess, with no hint of an effective remedy.

** Gold is still in a parabolic move, and nothing has changed after eight consecutive yearly rises. This means you must remain patient and focused. At this point, where else would you put your money? The persistent rise in gold will not suddenly end, especially considering that the public has yet to participate, let alone go crazy. To the contrary, most of the gold ballyhoo has come from mainstream economists and such notable gold-haters as Nouriel Roubini and Bob Prechter. As far as the public is concerned, they’ve been all too eager lately to liquidate their gold and jewelry. These are undoubtedly the same folks who got decimated in the dot-com craze and who segued into overpriced homes. Never underestimate the average Americans ignorance in financial affairs.

** Corrections do what they have to do. They will flush out latecomers, top-callers, in-and-out traders, the timid, dollar bulls, emotional investors and momentum players. None stand to reap much benefit from this historic bull market.

** Ignore the media’s take on markets. They have no real idea of what is going on, and if they did, like dissidents in China, they would not be allowed to publish their views. Most news is extraneous to market movements; and for the financial media, news serves merely as a convenient excuse to explain whatever the market did in a given day.

Best Clues are Technical

** The best timing clues are technical. These include overbought signals, or in this case, oversold charts that can be subjective but very helpful. And of course there is sentiment, which I have found to be the most useful. If all of these come together, then you can feel much more confident that you are at the point when gold can go up again. I believe we are there right now.

** Weakness in the large cap gold shares (GG, NEM, AUY, AEM, ABX, GFI)? As that peerlessly witty financial historian Bob Hoye likes to point out, such companies tend to trade in tandem with the stock market until the broad averages bottom. At that point, as mining companies’ costs decrease significantly, they start to lift off. Major gold firms did this in the very early 1930’s and have done so recently. They will detach from the stock market one day as the price of gold begins to explode.

** Gold shares generally anticipate tops and bottoms. So far this has not been the case, but expect them to do so shortly, just before the price of gold bottoms, presumably soon.

** Price behavior at a bottom: There are usually two scenarios. The shares might bottom, shoot up and then have one more short pullback to test support well above the low. Or, less commonly, they might simply explode to new highs and then correct. Right now, it’s anyone’s guess.

Conclusions

First, over the so-far eight-year-plus cycle in gold, we’ve seen numerous price declines in the metal but many more in precious-metal shares. There have been countless breathtaking gaps down in the shares — many more than gaps up. This behavior demonstrates the very nature of a bull market, perverse as that might seen. And yet, Goldcorp, my best barometer for the group, is still up about 15 times from its bottom in 2001. Second, most of today’s naysayers have been predicting a crash in gold all along its powerful rise. The odds that they will be vindicated at some point are slim, even as deflationary pressures abound.

I fully understand that there are massive deflationary forces in effect, and the deflationists have a very strong argument. Ordinarily, as happened until March 2009, a total meltdown could be anticipated. But with a major election in view, with shameless and ignorant politicians of both parties in office, with a Fed Chairman who fully understands the devastating nature of deflation, and given the ease with which the worldwide monetary authorities will push through whatever is expedient, the next rally cycle in gold and silver will be very dramatic.

‘Normal’ Not Possible

This is not to imply that we will have a normal economy once again — I don’t think this is even possible. But once stocks and precious metals bottom this year, we should see some exciting price movement ahead of the fall election. Without knowing exactly what next year will bring, we have a gut feeling it won’t be pretty.

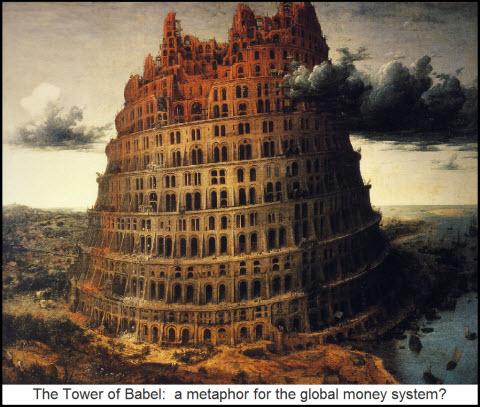

These are extraordinary times, and I see them taking on the character of Biblical events. In this atmosphere, there is going to be a shaking of all created things, most particularly a monetary system akin to a modern-day Tower of Babel. The price of gold, and by association silver, will go into the stratosphere, perhaps even into heaven itself where it is written that “the ultimate City of God will be made of pure gold.” For a professional consultation with Chuck, contact him by clicking here.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

“Other Paul 01.28.10 at 5:20 am

Most readers have never experienced a old, classic Friday payday with a paymaster having you sign for your wages and being paid in cash, on the spot.”

I was playing along and almost agreed, until I took a second to think about it. In the USMC we were typically paid cash and the sidearms were present. Later I was payed cash in an envelope every week.

Now I collect physical metal. Most of my friends collect FRNs in electronic accounts.