Are U.S. stocks and gold about to scream higher? Our good friend Chuck Cohen, a NYC-based financial consultant specializing in gold shares, thinks so. Although Chuck’s outlook is more dramatic than our own, we find his arguments quite plausible. Here he is, a bear turned unapologetically bullish, with some advice for investors — especially those who have been dithering over taking the plunge in mining stocks:

Since I have felt that the markets of the world are at a very important junction, I wanted to put out my revised views that connect with the near-term price of gold. With the stock market’s powerful, seven-month-old recovery closing on DOW 10,000, and gold bursting through $1000, many investors are anxiously wondering what’s next. Most seem to be very wary. I was a bear myself until a few weeks ago but recently reversed this stance. Yes, I know, there’s nothing more bearish than when bears start turning bullish. And I am aware that monumental structural defects remain. But the more I looked at the big picture, the less credible predictions of imminent collapse seemed.

Two key technical signs were missing. First, sentiment indicators lacked that excessive euphoria that has highlighted the recent market tops. This week, one of the more important short-term barometers, the weekly AAII survey, had more bears than bulls. Also, many of the other indicators reported in Barron’s are stuck in the middle ranges, show no signs of excess. And over the weekend, in the New York Times’ quarterly review of mutual funds, there was this cautious headline to alarm contrarians: “Maybe We’re Getting Ahead of Ourselves”. As the stock market has risen, it is clear that sentiment has turned more muted and cautious.

But more telling still are the stock charts. As I recently surveyed the excellent charts published by DecisionPoint.com, I realized that most did not suggest that a plunge is imminent. In fact, many of the market leaders have been moving up relentlessly, almost impulsively. At the very least, they should have topped and begun to descend, as they normally do in a major market decline. I also realize that it is the popular theory of the moment that the dreaded “C” wave, (part of the Elliott Wave jargon) is ready to make its appearance. But if there is such an animal, I don’t see it right now.

Seasonal Bullishness

And there is one more decidedly un-bearish factor: seasonality. We are in the final quarter of 2009, and it is typically a bullish time of year. Going back more than a generation, it was only in 1973 and 1987 that there were sharp declines during this time of year –and in both cases, it was not terminal. The 1973 drop began at the end of October with a 20% drop, but it then took almost five months before the market broke down again. The 1987 crash took six weeks from top to bottom, climaxing on October 16, and of course that was the bottom of the correction from 1982. The market never looked back for the next 12 years.

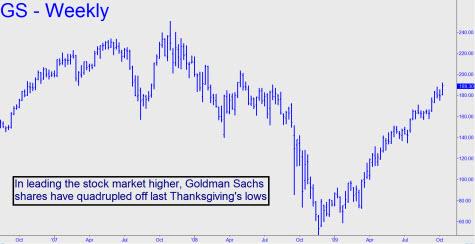

Market moves in either direction take their cue from certain leading stocks. At the moment, the leaders look very impulsive and strong. Take a look at your own charts, focusing on price action over the last year or two. Here is a list of representative stocks to ponder: in the retail sector, Amazon (AMZN), Gap (GAP), Kohl’s (KSS) and Penney (JCP); technology companies: Intel (INTC), IBM, Microsoft (MSFT) and Hewlett Packard (HPQ); banks and financials: Well Fargo (WFC), JP Morgan (JPM), Goldman Sachs (GS) Bank of America (BAC), General Electric (GE) and American Express (AXP); perennial hotties: Google (GOOG), Apple (AAPL) Research in Motion (RIMM); and major multinational companies: Caterpillar (CAT), Procter & Gamble (PG), MMM and Coca-Cola (KO). Although these major companies come from diverse groups, when you look at them collectively, you may conclude that the stock market is not ready for a “C” wave, or any other such dramatic collapse pattern.

Implications for Gold

The foregoing has bullish implications for gold, for two reasons. First, the stock market and gold, in particular the major gold shares, have been moving in lockstep since the bottom in March. This is not a revolutionary observation but it is nonetheless very important at this juncture; for if stocks are going up, then gold will join them. My theory, again not a radical thought, is that the unprecedented flooding of liquidity into the system is floating all boats: stocks, commodities, gold and silver. When and where this rise in stocks will end is purely guesswork, but my take is that it will go at least through January, perhaps morphing into a frantic panic into any asset that promises protection against inflation. We should never overlook the possibility that there’s a crowd waiting to join the party. They just hate to miss a good time. At this moment, my view appears to be a minority opinion, but it still seems highly plausible.

The second, and still most important point about gold, is that its long-term charts are in a parabolic rise. As this formation continues to develop, we should eventually see an acceleration, perhaps a dramatic one. Which brings me to my favorites, the junior mining and exploration companies.

Avoiding a Costly Error

The problem with buying these small, volatile and stocks is that you don’t want to chase them after you’ve become a believer and are emotionally engaged. By then, perhaps 50% of the move might be over. One of the primary reasons most people don’t maximize their profits in the gold shares is that they sit on the fence and wait until there is some real movement and media acceptance before they dive in. This can be a costly error, especially if your strategy is to get a good position in these shares and take the long-term approach in a cycle that is going to go on for years. Buying the juniors is not like buying shares of Wal-Mart or Google. They can be very volatile and very thinly traded. You might be tempted to buy one that has moved, because there is a certain intoxication about that. But it is best to have a real strategy where you can get in and out when it is timely and appropriate

Permit me to draw on some of my previous articles to further illuminate the current, fluid gold situation. I am doing this to remind you that if gold does not have a prominent place in your finances, it is time to reconsider. Here is what I wrote:

“The key to doing well in stocks is to be positioned in the correct longer term up cycle, and to be out of one that is heading down, although this is far easier to say than to do.”

Revving Up History

“At this moment, a once-in-history rise is revving up. It is in an sector that most Americans are uncomfortable with, and even ignorant of. It is the imminent explosive cycle in gold. The fundamentals are solidly in place for the rise-unlimited creation of paper currencies coming out of every central bank in the world, the exploding claims upon the U.S. dollar, declining mining gold production, a dearth of large discoveries in recent years, a virtual cessation of central bank selling of their gold holdings and a world-wide manipulation of the metal, particularly over the past eight years, that has produced an incalculable naked short position in the metal. As a friend of mine who knows the metals world intimately has maintained: The central financial issue of our time will be ‘what is money?’

“Because at this very moment, we are in the relatively early stages of a massive bull market in gold, with very few recognizing it or being positioned for the move. If you think I am exaggerating, then I must ask you, who do you know on CNBC or Bloomberg who is strongly advocating the gold market? Which quoted economists? Which friends, family or co-workers? Do you see what I mean?

“At the same time, why are the fastest growing nations, all situated to the east — Russia, China, India and the Middle East oil nations, all very favorable towards gold? Consider this: If the anti-gold, Western nations are faltering and selling their gold while the pro-gold countries are accumulating reserves and buying gold, logically what should be the future effect upon its price?

Not ‘All or Nothing’

“I don’t seek to persuade you to sell everything you own, put it all into gold and gold shares, and then barricade yourself up in a cabin in the Ozarks. Instead, I hope to try to make you understand that gold investments come in different sizes and shapes, with varying degrees of risk and reward. It’s not an all or nothing choice. The better you understand gold, its attributes, and how it fits into your financial makeup, the more you will feel more comfortable with it. You might then want to take bolder steps that can protect you more fully against the enormous unknowns facing us.

“Here is what I am getting at. If you are one of those who feel as though gold is too mysterious or too risky to get involved with, then I want you to seriously consider the first step. Approach gold just as you would with the different types of insurance you carry. You can get more deeply involved later. Your mindset has to be that if things don’t get much worse, gold may not do much and your finances will be healthy. Although, considering its performance over the past nine years, even through some good times and rising and falling consumer prices, it should continue to do well.

“The more we delve into the world economic and political landscape, the more attractive gold becomes and the more we might wish to expand and deepen our involvement. A corollary is that you may wish to reapportion some of the alternatives. I believe in spite of sharp stock rallies and declines, bouts of market optimism and pessimism, one thing is certain: We are in uncharted water. Fiscal problems that used to be reckoned in billions now tally into the trillions. As a result, no one can predict what the outcome will be.

Mining Money

“And that is what I expect this time, though to an even greater degree, since these companies are mining ‘money’ in its most pristine form, and the wind is at their backs. Many will be virtual mints in a time of incredible paper currency turbulence and destruction. Yes, they are speculative, but I like the odds. Here is a very fundamental point in investing: The greatest gains have been in those investments that were shunned the most. As Mr. Buffett — Warren not Jimmy – likes to say when asked about his success, “I buy when everyone else in selling and sell when everyone is buying.

“Many juniors are selling for the equivalent of $50 per ounce in the ground. This carries a ridiculous leverage. If a company has a proven one million ounces in the ground and a $10 million market cap what is its true potential value? It takes very little imagination to consider what their properties would be worth at $1500 or even $3000 gold let alone if their resources climb to 2 or 3 million ounces.

“Above all, there are the two overriding reasons to own gold — one fundamental, the other technical. Concerning the former, the monetary landscape and the certainty of more and more fiat money will keep the gold fires burning brightly. As for technical reasons, on the charts, gold has been consolidating for years to launch into a parabolic rally.

I am available professionally to help you in this area if you need direction, stock suggestions and aid in placing your orders. We can talk about your situation and try to prepare you for this historic time. I can help you also in placing orders. Please contact me at ikiecohen@msn.com Thanks again. Chuck. “The prudent see danger and take refuge, but the simple keep going and suffer for it.” Proverbs 27:12.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Hi Socrates,

understood but may I ask your opinion on an influencing factor not mentioned above. Yes it is easy to see the deflation happening particularly in the U.S., also Europe. Geez, everything’s on sale. But to my question, China, along with its Asian siblings, has resolutely risen as the economic power and here in China, there is enormous spending and growth/bubble INFLATION now. How might this impact or offset the U.S. deflationary issues? Cheers, Mario