The Rick’s Picks chat room was abuzz yesterday with anxious talk about a possible $100 swoon in gold over the very near term. Fears may have been stoked by a subscriber whose predictions have been prescient. Indeed, this fellow foresaw $60 crude when it was falling into the low $30s, and he was more bullish on stocks at their last bottom than just about anyone else we know. Now, although his long-term outlook for gold is quite bullish, though no moreso than our own, he’s looking for a sharp pullback as the summer begins. We don’t see it and are instead looking for an immediate push to $1008, basis Comex August, with a follow-through that carries to at least $1066. It is from those height that Gold could stall, according to our runes, but the odds are just as good that the rally could keep chugging all the way into the low $1200s before taking a serious rest.

In any event, it’s plain to see that bullion hasn’t been paying bears much mind lately. The rally from mid-April’s lows is now in its seventh week, and buyers have been noticeably unintimidated on the few days when the U.S. dollar was strong. A possible reason for gold’s steady but unspectacular climb occurred to us as while we were reading letters to the editor in Tuesday’s edition of The Wall Street Journal. A few of them took pot shots at an op-ed piece, “Why Beijing Wants a Strong Dollar”. We find nothing exceptionable about the premise of the headline, although the letter writers’ consensus was that the U.S. shouldn’t rely too heavily on continued fiscal support from the Chinese government. We agreed in particular with one of them when he wrote as follows: “Simply because the Chinese currently have a portfolio consisting of huge Treasury security holdings, that does not mean they will forever continue to throw good money after bad…”

Hooked on Fiat

Just so. But we would go a step further in suggesting that, not only have the Chinese already written off more than $1 trillion in U.S. dollar exposure, they have furthermore been aggressively hedging currency risk with steady purchases of bullion in world markets. Although hard evidence of this is difficult to come by, it would be astounding if China were not pursuing this course, since it arguably affords them sufficient leverage not only to weather a collapse in the dollar, but to come away from such an event greatly strengthened relative to a Western trading bloc still hooked, literally, on fiat currency. We’d also be surprised if China were the only sovereign entity hoarding gold against the day when the U.S. realizes it is bankrupt. And that is why we still view gold, even at the lofty price of $1000 an ounce, and even believing as we do that deflation will asphyxiate debtors first, as a no-brainer investment.

***

Calling All Traders…

Ever found yourself sitting on your thumbs after the opening bell, waiting for the dust to settle? If so, then you know how much harder it becomes to trade profitably as the day wears on. That’s because once a market has established an opening range, trading becomes essentially a frustrating game of second- and third-guessing other traders who are trying to second- and third-guess you.

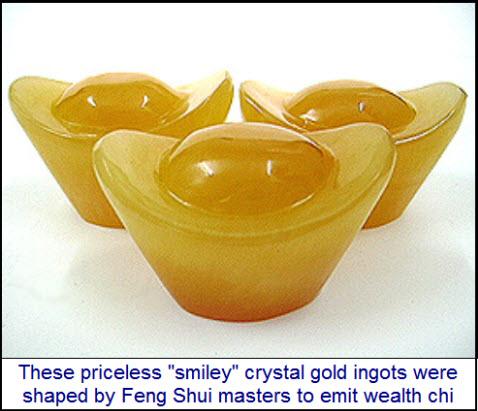

But suppose you were able to predict the high or low of the opening range beforehand? Using your crystal ball, you could be waiting at the bell with your bid or offer, ready to pounce on what will later turn out to be the high or low of the day. Now wouldn’t that be a trick!

That is exactly what we attempt to do each morning, using the Hidden Pivot Method to spot predictive price patterns that may have occurred overnight. If you want to see how this is done, and how precisely, please join me online for The Morning Briefing each day before the opening this week and next. Beginning on Monday, June 8, these 20-minute sessions will commence sharply at 9:00 a.m. EDT. Our goal will be to identify trading opportunities for that day, with a particular emphasis on Comex Gold futures and the E-Mini S&P. The Morning Briefing will be open to all, but to sign up you will need to click on a link at the bottom of the free commentary that I send out via e-mail each day. If you are not already receiving this publication, click here to have it delivered starting tomorrow.

See you Monday morning!

To be clear on my $120.00 gold drop-Gold was settled at 982.30, so my target remains $862.30. 200 ma=864.30.

Clear H&S on silver. Stocks topped out on Friday, another clear short for at least 1200 dow point drop. Dollar will rally more next week.

Yes Rick A.-Time Square Hula is on if gold does not make my call by June 14.