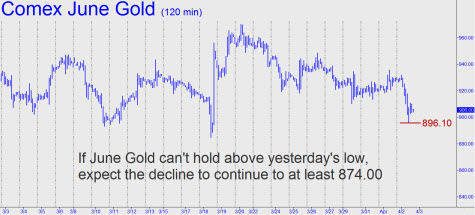

Rick’s Picks subscribers were well prepared for the diabolical price action in gold yesterday, since a forecast sent out the night before caught both the high and low of June Gold’s $35 swing almost exactly. Comex futures were in a promising rally when we published an advisory just after midnight that warned of potential trouble precisely at 931.60 (a “Hidden Pivot” resistance). Gold in fact topped moments later at 931.80, then plummeted to 896.10 — just 80 cents from a bearish target we’d spotlighted in yet another midnight bulletin. Price action in the E-Mini S&P proved equally felicitous, since we’d identified a rally target at 843.75 that came within 1.50 points of nailing the top of yesterday’s 37-point surge. That target also went out to subscribers in the wee hours on Thursday.

So what are we forecasting now? More of the same, actually. If Gold takes out yesterday’s bottom, it is likely to fall to at least 874.00 or to 856.00 if any lower. As for the S&P futures, currently trading for around 835, they look like a good bet to rally to at least 852, which would imply a 150-point surge in the Dow Industrials. The picture of strength is reinforced by the strong leadership of Goldman Sachs, a favorite bellwether of ours that looks all but certain to reach a Hidden Pivot target at 120.34. With the stock trading in the $90s a while back, we advised purchasing some July 115-April 115 calendar spreads for $6, and the trade has worked out nicely. But with a further rally to $120 now in prospect, we advised adding some July 120-April 120 call spreads to the position for 9.80. This spread could widen to as much as 18.00 if Goldman shares are sitting just below 120 when the April options expire in two weeks.

Leveraging Google Target

In Google, a June 390-April 390 calendar spread looked tempting for $12 when we examined the stock during an impromptu webinar held for subscribers yesterday morning. We keyed on the 390 strike because we are anticipating a $25 rally that would push GOOG up to around $387. Please be aware that option trading can be risky, and that any gains we have made trading puts and calls in the past do not guarantee that future option trades recommended in Rick’s Picks will be profitable. You should check with your broker to determine whether option trading is for you.

If you want to know more about the calendar-spread strategies we use to dramatically reduce the risk of holding puts and calls, click here for a detailed description; and here if you want an even more detailed article on the topic that we wrote for Stock, Futures & Options magazine.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

The “piddling” consumer inflation won’t be so piddling when a loaf of bread costs $100. As I noted it will START with consumer goods inflation. A loaf of bread at $100, or even $20 or $50 would be dire in terms of perception of the dollar’s value. It is then that the race to acquire real assets will start in earnest thus “spreading”. By the time hyperinflation spreads to real estate, the dollar will be so worthless (and getting more so by the hour) that nobody in their right mind would even consider measuring their net worth or “gains” in terms of it. I am sure nobody is speculating in real estate in Zimbabwean dollars anymore. We live in a society where not everybody possesses an equal amount of money. 20% of the population has a lot more money than the remaining 80% and it is the 20% that will be doing most of the bidding. The rest of the 80% unfortunately are at risk of perishing. Nobody said hyperinflation will make you rich.

And it would be foolish to ignore the lessons of history where every – EVERY – fiat currency has died the hyperinflationary death. You may not like it, or may not be able to imagine it, but it’s just math. It is not a question of what Obama and Ben are willing to do or not. The matter is simply out of their hands now

Another point I would like to add is that a lot more people would be defaulting than servicing their debt (an additional consequence of which is that the money borrowed by them is still in circulation). Hyperinflation will not arrive in time to bail out the underwater homeowners. Most of them will have defaulted and be homeless by then. Nobody “wins” in a hyperinflation. People are either rescued or not. The deflation analysis only works for a Gold based monetary regime, not a purely fiat one.