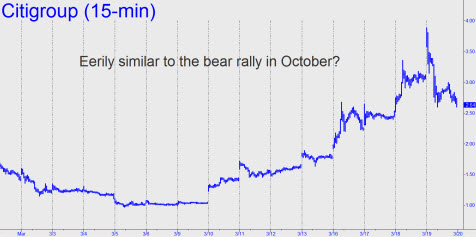

Today we feature the work of our good friend Chuck Cohen, who combines technical savvy and horse sense better than just about anyone we know. He thinks Citigroup’s meteoric rise in recent days bears eerie similaritites to the stock’s spectacular bear rally last October, when it rose from 12.85 to 23.50 in just two weeks. Then, as now, he recalls, the hubris was deafening Here’s Chuck:

“Back in October 2008, the stock market had just completed a very sharp drop dragging the Dow down to just under 8000. A sharp relief bounce carried the averages up to about 9,300 by the end of the month. At that time, most of the commentators, who never saw the severity of the decline coming, proclaimed that the correction was over, the worst had been discounted in the financial area, and stocks were once again a strong buy. But as I have pointed out on many posts [at LeMetropole.com], there was something missing in this happy view. There was never any real pessimism displayed in the sentiment indicators and in the financial media. Those who never told their readers or listeners to be careful all the way down were still saying ‘buy.’ Their advice was to ‘average down’ and continue to buy stocks, for over time this strategy has always worked out.

“But as I looked over some of the financial charts, I was struck by one very disturbing chart: Citigroup. So I submitted my analysis to Bill [Murphy of LeMetropole] on October 31, having little inkling how far this key company would fall, and what it possibly meant. The article is repeated below to explain my reasons back then for being so bearish. This brings us to the current situation. This week an 800 point rally in the Dow has once again generated a huge amount of joy and confidence in the financial media and among many of the permabulls. The argument remains the same as it was five months ago: the worst has been discounted; and to hammer this home, one after another of the architects of the disaster are being quoted around the clock. The only people missing are Sir Alan Greenspan (“Don’t blame me…”), Robert Rubin (“Don’t blame me, either…”) and Bernie Madoff (“I did it but I knew what I was doing.”) If you think I am exaggerating, please click on Barrons.com and CNBC.com and read the headlines.

Where’s the Fear?

“But, as I did back in October, I looked once again this weekend at the now lowly Citigroup’s chart, and amazingly, noticed some eerie similarities to the Citigroup chart back in October. This is just a 10-day chart, but look at the spikes up on the openings even before Citigroup broke a buck , and more interestingly, note that it has gapped up 3 out of the past four days. Does that reflect fear or as we can see back in October, an impatience that rarely comes at a true bottom?

“This is my point. If the October situation brought the stock down over 95% in four months, what will this situation possibly mean? My guess is that this rally is destined to fail. It might be this week or perhaps after a test of the rally top, in three weeks. But a failure and a break of the bottom, especially considering the incredible bullishness in the VIX and in the put-call ratio, we will plunge into an unthinkable collapse and panic.

Gold at Unimaginable Levels

“I realize that outside of [LeMetropole], this is a totally radical, un-American view. But for those of you who have been longer-time subscribers, you certainly have been warned over and over of the end-game. We have been warned of a stock market collapse, a housing disaster and very possible social and economic chaos with the price of gold eventually going to unimaginable levels. The last two events have not yet come, but I believe they are very close.

“Only one generation was chosen to be the final one before the Lord’s return, and I believe that it will be ours.”

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Hi Rick,

I sent the last paragraph of your comment to my Pastor for his comments and set out below is what he says. I’m not being argumentative but taking your important comment and asking for a qualified second opinion. What do I think now? Hmm.

Brgds

Leo

Subject: Re: Bible quote

Hi Leo

All through the centuries Christians have believed in the Second Coming when God who created the World and who redeemed the world through Christ, will return in the person of Christ and wind all things up. There are three distinct ways in which Christians believe that will happen. Clearly we are nearer His return than ever before but its dangerous for anyone to say we will be the ‘final generation’. Jesus says it is not for us to know the timing of His return but we need to live with the urgency that it may be soon. The Bible also gives us clues about the signs which will mark the final days before His return and certainly a lot of what is happening rings true to what is written.

The Christian writing this is clearly convinced its the end game: I don’t share his assessment as yet!!

Pastor David

On 20/3/09 16:22, “Leo Fitzpatrick” wrote:

“Only one generation was chosen to be the final one before the Lord’s return, and I believe that it will be ours.”

*****

Thanks for sharing your pastor’s thoughts on this topic, Leo. I received this response from Chuck:

Thanks for the feedback. Obviously, my opinion is in the minority with your readers, but then again my take on the entire world situation especially the economic problems has been a minority view over the past 8 years. Perhaps you can refer the Pastor to the 2nd and 3rd seals in Revelation and the fact that Israel is once again a nation. According to the New Scriptures Jesus will return to Jerusalem immediately after the Tribulation, and the rule of the Antichrist system. The end could never have occurred before our time because Israel did not become a nation again until 1947. He is correct in saying that no man knows the time but we are to be watchful and alert that he might come at any time.

My point is that I am certain we will go into chaos and the governments of the world will take over all economic activity, requiring its inhabitants to sign on for help. Thanks again. Chuck

ps: This market is a hoot. We again have a panic to buy after a weekend and gold down. They never give up trying to find a bottom so they can make a quick buck. The next leg down will be swift and frighteningly sharp.