Over One Thousand Paid Subscribers Won’t Make A Trade Without Looking At Rick’s Picks First…

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Rick's Free Picks

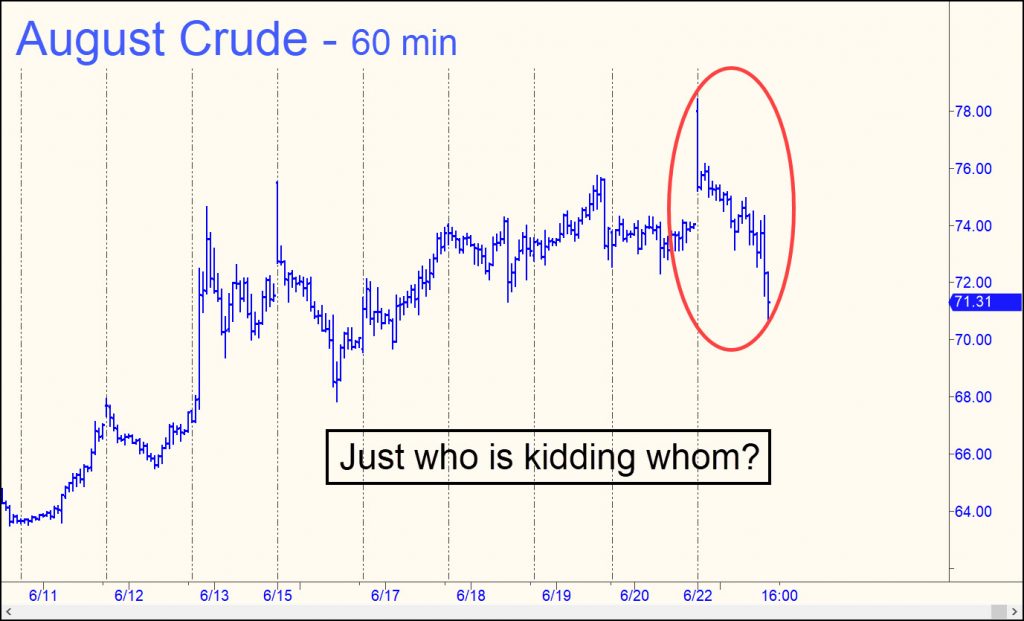

CLQ25 – August Crude (Last:66.71)

Right on cue, Bloomberg.com splashed an article on its front page over the weekend explaining why the price of crude has been so subdued in the face of potentially severe supply disruptions in the Middle East. Turns out the world is awash in oil, the article explained — not just

TLT – Lehman Bond ETF (Last:84.55)

We should know soon whether Silver’s mini-explosion upward, the second in three months, is just another false start. From a Hidden Pivot perspective, the selloff of the last two weeks is not as bearish as it seems. It triggered an attractive ‘mechanical’ buy on Monday when it touched the green

CLM25 – June Crude (Last:60.90)

Quotes for crude have turned up from an odd place, well shy of a ‘secondary’ Hidden Pivot support at 49.25. Odds of a relapse will depend on how bulls fare pushing past a minor Hidden Pivot resistance at 62.22, and another at 65.68 (60-min, A=56.42 on 4/9). If both of

Member Content

Unlock member content with a free trial subscription

THE MORNING LINE

Wall Street’s Epic Bunco Game

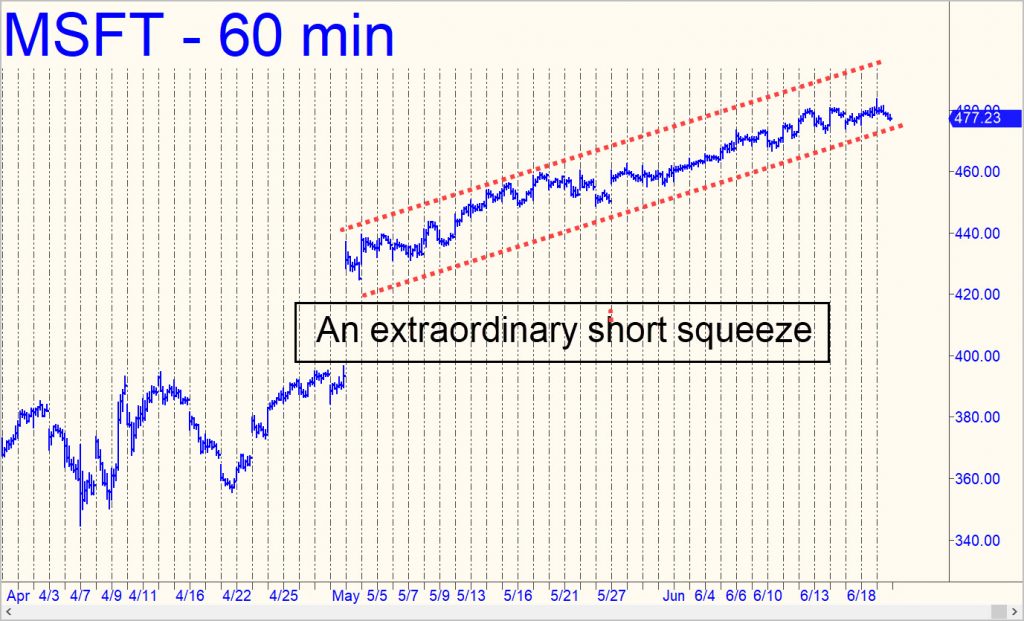

Tulipmania and the South Sea Bubble have nothing on the bunco game Wall Street has been running with Microsoft shares. I write on this subject often because the numbers are so huge, and because the game, which is intertwined with the biggest financial con-job in history, is not one you will ever read about in The Wall Street Journal or on Bloomberg.com. It thrives on the madness of crowds and grows bigger with every uptick in MSFT and the galaxy of stocks in its vortex. Microsoft’s share price has gone from 393 to 483 since April, adding roughly $687 billion to the macro ledger. That is twice the size of California’s budget for 2025. It would buy a Porsche 911 for every man, woman and child in New York and Chicago, or a super-deluxe Disney World vacation for every family in America.

A clue to how the game works lies in the relentless smoothness of MSFT’s ascent. You could comb through a thousand charts without finding one remotely like the one pictured above. You don’t have to be a technical analyst to see that the long rally has been tightly controlled every step of the way. This kind of price action is quite rare, but what makes it extraordinary is that it is not happening to just any stock, but rather to the most valuable stock in the world, a $3 trillion company with a lock on the operating systems of a billion-and-a-half desktop computers. The stock has been ratcheting higher on relatively thin volume and a dearth of bullish buying. Short-covering has done most of the lifting, with more urgency and power than merely optimistic investors could ever supply.

Ka-Ching!

MSFT’s manipulators knew what they were doing when they goosed the stock into a sensational short squeeze on April 30. On that day, after the close of business, Microsoft announced earnings of $3.48 per share on revenues of $70.07 billion, beating the consensus estimate by 24 cents a share. That might not sound like much, but it was enough to spook wrong-way bettors into gapping MSFT $48 higher on the opening bar the next day. Ka-ching! Another $366 billion worth of instant wealth-effect. Even Wall Street’s perpetually bullish analysts couldn’t have imagined the rally would add another $321 billion of unearned gains since then. And yet, here we are, with the stock in record territory and no top in sight. It doesn’t get any better than this, which is why MSFT cannot continue to climb. When it falls hard for no apparent reason, which it will, that will mark the end of the bull market and the hubris that has sustained it for 16 years.

What our customers are saying about us...

Forecasts Delivered Before

The Morning Trading Bell Rings

As a Rick’s Picks subscriber, you will be getting this information the moment it’s posted on the membership site, usually shortly after midnight Eastern Standard Time… more than enough time to capitalize on Rick’s suggestions.

Then, throughout the day as Rick updates his forecasts with additional guidance based on market conditions, you’ll be instantly informed via email alerts… allowing you to take full advantage of breaking trends and market fluctuations.

These picks include a rotating basket of stocks, futures, indexes, and other hot issues, with a daily focus on precious metals. Rick’s Picks subscribers have their favorites, so Rick regularly covers Comex Gold & Silver, the NASDAQ, the Euro, and the E-Mini S&P in addition to the hot issues he believes will offer significant profit-taking opportunities for his subscribers.

Each specific pick is hand-selected by Rick, and includes actionable trading advice, specific price targets, and annotated Hidden Pivot charts with supporting data.

Your Free Subscription Includes:

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- ‘Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Your Satisfaction is Guaranteed

Once you see how powerfully accurate Rick’s forecasts truly are, we’re sure you’ll stay on as a full member. But if for any reason you’re not convinced, simply cancel before the two week’s end and you won’t owe us a single dime. Fair enough

Paid Subscriptions We Offer

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others