Days like yesterday could cast doubt on a prediction made here a short while ago — that the Dow Industrials are about to embark on a 1400-point rally. We still expect this to happen, although when we try to think it through logically it makes no sense whatsoever. As why should it, given that the global economy is presently sustained by little more than lies, political corruption, smoke and mirrors? Even natural winners like Australia and Brazil appear to have embraced the brazen fraud of monetary stimulus. Obviously, they’re trying to gain an edge. But on whom? An oddity is that, unlike in the late 1920s, talk of punitive tariffs has been relatively muted. Have politicians finally taken to heart the law of comparative advantage? Probably not. All they know, assuming they know anything, is the law of the jungle. Perhaps they’re simply resigned to the fact that no nation that exports manufactured goods can ever hope to out-cheat China. For their part, the Chinese have at least spared us the agony of having another Smoot-Hawley tariff grind its way through the D.C. sausage factory.

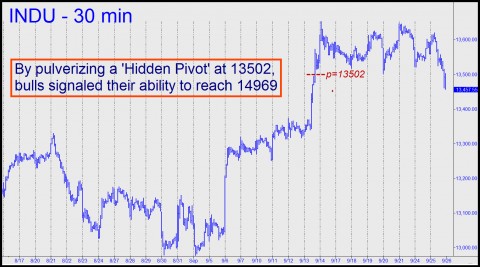

In the meantime, and putting yesterday’s drubbing on Wall Street aside, the U.S. stock market continues to work its way higher. But 1400 points higher? The very idea of it sent “Mega-Bear” into overdrive yesterday in the Rick’s Picks forum. “How about screaming, short-term, WAY-overbought technicals,” he asked, “like MACD, RSI and Bollinger bands”? To be frank, we don’t put much store in such stuff, since none of it has worked very well since this Mother of All Bear Rallies began in March 2009. What we do trust – completely – is the bland proprietary indicators of Hidden Pivot Analysis. They are in fact the reason why, on September 19, when the Dow Industrials blew past a “midpoint Hidden pivot” at 13502, we “knew” that the blue chip average would eventually hit 14969. Not that we’d stake our life on it. Indeed, we’ve mentioned here several times before that, bullish as our indicators are right now, we interpret and use them with one leg out the fire escape window. Nor do we assume that the financial disaster that most certainly lies ahead will unfold with sufficient deliberation to make our exit strategy feasible. Probably not. But we prefer to be optimistic about it.

Apple a Crucial Bellwether

From a tactical standpoint, Apple remains the bellwether to watch. And while the stock has gotten socked for a nearly 5% loss in the last two days, we’re betting that it will soon recover, as it always has. To leverage this prospect, we’ve advised subscribers to buy out-of-the money calendar spreads — the cheapest and least risky play we can think of based on our nearly 40 years of option-trading experience. (For further details concerning this strategy, click here for a free trial subscription that includes access to Rick’s Picks 24/7 chat room and the just-launched ‘Harry’s Place’.) We should note, finally, that in the last week or so, to get a fresh start, we advised cashing out some AAPL call spreads, naked-short puts and put calendar spreads that had been legged on earlier. Each turned a theoretical profit, by the way, as you can verify yourself via a free trial subscription.

Martin Armstrong:the eventual bubble we will see should be catastrophic and when I say the Dow could easily hit 50,000, I am not kidding!