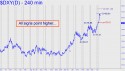

Two compelling trends, both of them nicely visible on the 240-minute chart (see inset), imply that DXY is bound for a minimum 80.10 once it surpasses a lesser ‘D’ target at 79.17. So far, the index has stalled within two ticks of that number, a Hidden Pivot midpoint resistance, but once above it the run-up to 80.10 would become an odds-on bet. Lest we be caught without an even more ambitious target if buyers should run amok, here it is: 81.49 (A=74.68, B=78.86, C=77.31). At that point, the dollar will have rallied 12% from its early-May lows, but it would need to reach 87.50 for the 20 percenter that would qualify as a bull market.

Two compelling trends, both of them nicely visible on the 240-minute chart (see inset), imply that DXY is bound for a minimum 80.10 once it surpasses a lesser ‘D’ target at 79.17. So far, the index has stalled within two ticks of that number, a Hidden Pivot midpoint resistance, but once above it the run-up to 80.10 would become an odds-on bet. Lest we be caught without an even more ambitious target if buyers should run amok, here it is: 81.49 (A=74.68, B=78.86, C=77.31). At that point, the dollar will have rallied 12% from its early-May lows, but it would need to reach 87.50 for the 20 percenter that would qualify as a bull market.