Ahhh, it’s those old Greek worries again! Yesterday they were blamed for undoing a nearly 150-point rally in the Dow, although the question of what had caused the rally to begin with seemed of less concern. We’ll proffer the usual, technical explanation: Yesterday’s ups and downs were caused entirely by algorithm-driven machines with nothing more on their tiny digital brains than a bunch of zeroes and ones. And if they had a smattering of human help, the humans undoubtedly applied the same tried-and-true tactic that has carried the day for the hedgies time and again in recent months – i.e., letting the index futures fall on thin volume, exhausting sellers overnight; then inducing a short-covering panic ahead of the opening bell.

Would that Greece were driven by algorithms and polymath dervishes! Granted, this wicked combination could send millions of Greeks into manic-depressive fits and potentially suicidal lows. But, oh, just think about those highs — just like the ones we thrill to nearly every week on Wall Street, where even the glowering menace of a Second Great Depression evidently cannot kill the insensate ardor of buyers. So, if 300-point Dow rallies are still possible, why hasn’t the same kind of exuberance seized the proletarian mind in Athens? The answer, of course, is that Greece’s mood is driven not by “technical factors,” but by the grim realities of a failing economy and an economic future utterly bereft of hope. Greek businesses cannot get bank loans to tide things over while their customers try to scrounge enough cash to redeem their IOUs. This has by now developed into a vicious cycle that can only spiral outward until it has encompassed all economic activity. In the meantime, a Europe desperate to save the euro and a transnational political confederation that had been dreamt about by political elites for a hundred years, has imposed on Greece a regimen of austerity that can only hasten the nation’s psychological exhaustion and slide toward default.

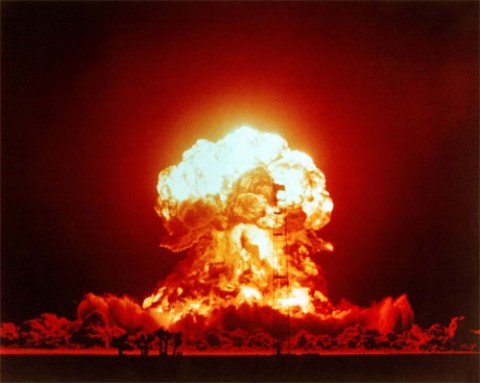

Belly Up for Greece

Has this outcome been factored into “the markets”? Yes and no. While it would appear that expectations of Greece going belly up are nearly universal, we cannot predict whether the event will cause a tsunami that takes Italy and Spain (and France?) with it. For their part, traders seem to be taking the Zen attitude that we shouldn’t worry too much about those things that we cannot change. And although only a handful of bureaucrats in Belgium and a few ivory-tower eggheads would maintain that Greece is not about to submerge, we’ll simply have to wait and see whether Euroland and the global banking system can survive the shock. There is no question that the markets have been extremely volatile, reflecting the nervousness of traders and speculators still in the game. But if these bold players were to reflect for more than a moment on what outcomes are likely, let alone possible, the Dow would be trading 5000 points lower in a trice.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Really good writing Rick.