Don’t let this nasty shakedown in bullion scare you. For the record, we are quite confident that gold and silver will be back on track soon, bounding toward new record highs. But both may have a little farther to fall if forecasts disseminated earlier to Rick’s Picks subscribers prove correct. Specifically, we’ve been drum-rolling a possible 1709.20 bottom for Comex December Gold, and a 35.70 low for December Silver. As of yesterday, the latter had overshot its target by 17 cents, hitting a 34.53 low that in a single day shaved 10 percent off the value of the world’s store of silver. Gold, for its part, didn’t quite reach the 1709.20 target, instead turning higher from 1723.20. We think the December contract’s so-far $29 bounce from that number will prove short-lived and that the futures will make an important low at or very near 1709.20 today or Monday. If so, this is likely to put pressure on Silver, perhaps pushing quotes below $35 for a day or two. In any event, if the selloff in bullion is not over already, it will be soon.

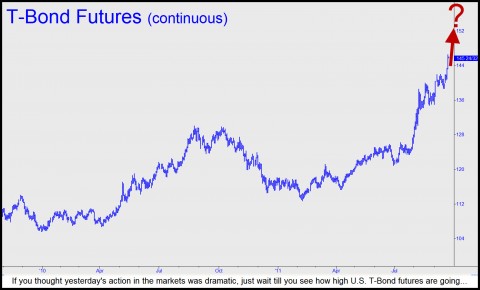

Those who follow Rick’s Picks closely would not have been surprised by yesterday’s across-the-board avalanche in commodities and currencies. The night before, a commentary bearing the headline “Strong Dollar Predicting Europe’s Breakdown” went out to subscribers and readers. Our actual target for the Dollar Index lay well above, at 79.86, but yesterday’s explosive move came within 1.06 of hitting it. We remain confident the target will be achieved, albeit earlier than we might have expected. If so, and the dollar’s rally has further to go, yesterday’s dramatic unwinding of the so-called “risk trade” will continue apace. How much farther? We’ve provided subscribers with a precise target for the December E-Mini S&P futures, and although the carnage could conceivably end with a relapse today down to 1088, about 20 points (or 160 Dow points) beneath yesterday’s low, any slippage beneath that number would, from a technical standpoint, have potentially grave consequences for the near and intermediate term. We’ve also included in today’s “Touts” section of Rick’s Picks a precise and extremely bullish forecast for T-Bond futures that if correct implies that long-term interest rates are about to fall to levels that few have imagined, at least in print. If you want to be on top of our detailed forecasts and trading recommendations, and to have access to a chat room that draws top traders from around the world at all hours, click here for a free trial subscription to Rick’s Picks — or here to receive our commentary free each day.)

Those who follow Rick’s Picks closely would not have been surprised by yesterday’s across-the-board avalanche in commodities and currencies. The night before, a commentary bearing the headline “Strong Dollar Predicting Europe’s Breakdown” went out to subscribers and readers. Our actual target for the Dollar Index lay well above, at 79.86, but yesterday’s explosive move came within 1.06 of hitting it. We remain confident the target will be achieved, albeit earlier than we might have expected. If so, and the dollar’s rally has further to go, yesterday’s dramatic unwinding of the so-called “risk trade” will continue apace. How much farther? We’ve provided subscribers with a precise target for the December E-Mini S&P futures, and although the carnage could conceivably end with a relapse today down to 1088, about 20 points (or 160 Dow points) beneath yesterday’s low, any slippage beneath that number would, from a technical standpoint, have potentially grave consequences for the near and intermediate term. We’ve also included in today’s “Touts” section of Rick’s Picks a precise and extremely bullish forecast for T-Bond futures that if correct implies that long-term interest rates are about to fall to levels that few have imagined, at least in print. If you want to be on top of our detailed forecasts and trading recommendations, and to have access to a chat room that draws top traders from around the world at all hours, click here for a free trial subscription to Rick’s Picks — or here to receive our commentary free each day.)

Our beloved PM’s along with everything else except bonds took a serious hit when The Bernank did did not promise to supply any QEIII. Instead he opted to rebalance the fed balance sheet from short to long in order to lower long term interest rates. Lower long term inerest rates? They are already at rediculous levels. I suppose he could be trying to lower the CPI next month to prevent SS receipients from getting to big of a COLA adjustment, but I don’t think so.

Suppose, and this is just a hypothesis, that he sees something really frightening. He sees a huge sea of unpaid interest about to collapse his lovely dam of debt. The fatal flaw of a fiat money system is the interest payments not the buildup of debt. The flaw is that interest is never really paid on that debt. No provision is made in the lending and payment process for the interest that is added to the principle at payment time. Early borrowers can only pay the interest portion of their debt by getting a little piece of later borrowers principle. All interest is rolled onto later borrowers. When the final borrowers (sovereigns) start defaulting there is no one left to take their place and the debt dam is in danger of breaking down.

The system is like a Beaver dam. The beavers build a dam across a small stream, a lake begins to build up behind the dam. The beavers keep building, the lake keeps growing until the beavers run out of trees. Central bankers run out of new borrowers and the dam breaks. Lowering long term interest rates is an attempt to slow the flow into the lake because there are not enough borrowers.

Just a hypothesis.