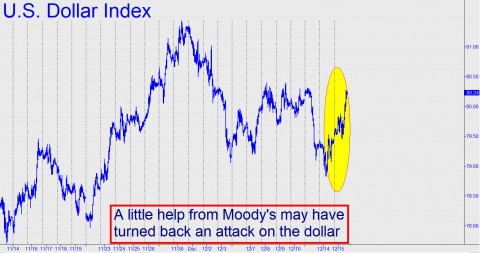

Bullion prices seem likely to remain under pressure for the rest of the year now that Moody’s has trained its water hose on…Spain! Yesterday, the ratings firm dithered its way into the headlines with a threat to downgrade Iberian debt. Presumably, this was done at the behest of Geithner, Bernanke & Friends. Regardless of who ordered the hit, it sufficed to touch off yet another headless-chicken scramble into the alleged “safety” of the U.S. dollar. The timing of this conspiratorial boost to the buck suggests that the Plunge Protection Team is getting better at its job with each passing month. By our runes, the dollar was poised for a breakdown. Lo, just as the selloff begun on Monday was starting to snowball, the dollar whipped around and began a steep rally that was still in force at yesterday’s close. If we’d stage-managed the turn ourselves using Hidden Pivots to time the announcement, we could not have picked a more opportune spot for Moody’s and its masters to spring a trap on dollar shorts.

Curiously, although the threat did its job, turning a weak dollar lethal to anyone betting against it — while of course knocking gold and silver futures for a loop — Spain’s borrowing costs remained largely unchanged. Spanish bond yields actually ended the day lower, suggesting, as the Wall Street Journal put it, that “investors may have become immune to such warnings.” Do lenders know something that the rating service does not? At the very least, it would appear that they had the jump on Moody’s, since yields on 12- and 18-month bills issued by Spain had risen a full percentage point since mid-November.

Dealing Off the Bottom

From a technical standpoint the Dollar Index, currently trading around 80.24, will become an odds-on bet to hit a minimum 82.23 by year’s end if it can blow past a “Hidden Pivot” resistance at 80.57 today or tomorrow. But the target will become a virtual lock-up as far as we’re concerned if the Dollar Index closes above 80.57 for two consecutive days. That would equate to a rally of about 2.5%, and it would surely put some weight on gold and silver quotes. However, bullion investors should have become used to playing in a rigged game by now, especially when Europe’s problems are the distraction used to allow the likes of Moody’s to deal from the bottom of the deck. Such shenanigans may slow the rise of gold and silver for a short while, but if you look at where they were trading a year ago, or two years, or three years, or a decade, it becomes clear that market forces are prevailing over political muscle. (To gain free access to Rick’s Picks precise daily forecasts for gold, silver and all other trading vehicles, click here.)

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Hi Gary, I greatly appreciate your sense of the issues at hand.

On your comment “Cash will prevail. It always does in a deflation.”

…this is why I think the Jim Chanos short is idiotic and narrowminded. He keeps talking about how China will crash essentially because too much of the reported GDP is in real estate/construction. (Every time I hear him say there are empty cities in China as if its a major leading indicator rather than a small and unusual aberration, I laugh harder and harder. Chinese who own apartments they are using as an asset store, not for living, and with no or small mortgage, will pass them on to their kids and don’t hang the quality of their life on whether the property value goes up or down. He just doesn’t get that nobody cares about what he thinks they should care about.)

So then, while it is true that real estate/construction is a questionably big chunk of China’s GDP, it is not a singular reason that offsets the other side of the reality that people continue to give little weight – CASH.

Any country such as China with trillions in cash and asset equity will crash? Which economies crash folks? Ones with trillions in cash or ones with trillions in debt? I don’t think its the ones with the cash. Is there no respect any more for those that have saved for the rainy day? The beauty of having cash cash cash and less debt load is that when the S#@%t does hit the fan, you’re still relatively OK and often, you’re the one left standing. That’s true on both a micro and macro scale. While in the case of the U.S., printing more cash into a globally expanding economy might not be such a bad idea in the end if that money somehow trickles down into the right crevices, but that’s one of many separate subjects for further treatment.

Assuming cash has some continued reasonable but continually declining purchasing power as history has shown us so far, its easy to agree with your point that cash will win out in the end. Hell, Wall Street has become little more than a private club, though so few realize it. Speaking to whether the entire system will come crashing down as a whole where all assets/currencies plummet in value, economies collapse, disintegrate in a cyber financial nuclear explosion, or whatever, I can’t express an educated opinion on such unlikely but possible extremes.

And one last point, it is more painful to be in cash when interest rates are low. People have not historically liquidated their holdings out of stock markets when interest rates are low, as is the case now. Show me a stock market crash with interest rates near zero. I remember this rule from the days of the Charles Given’s 80’s!! So, indeed if yields do somehow start to steadily creep up despite efforts to the contrary, oh boy watch out below, people will indeed start to run to their perception of the safer sweeter yields on cash, the USD will again strengthen, while then stocks and even gold and silver will plummet. Geez, its just too much to contemplate.

Thanks for listening Gary!

Cheers, Mario