Stocks extended their rally for a third consecutive day, with computer-driven buying accounting for nearly all of the gains. How do we know this? Why, we read it in the Wall Street Journal: “This is a big vacation week,” noted one equity-desk veteran,” but the computers and servers are still cranking them out.” We assume that “cranking them out” means generating buy and sell orders irrespective of human participation or volition. Sort of like what happens when the Ferris wheel operator disappears for 15 minutes with a flask and a gal in a polka-dot dress. The Journal cited another catalyst as well: a frenzy of trading in the final 30 minutes by exchange-traded funds (ETFs) playing catch-up.

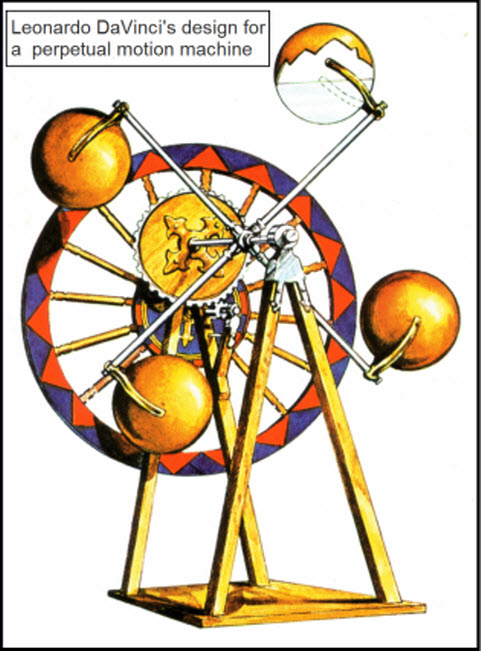

This supposedly has been going on since June, and one wonders whether the Masters of the Universe have finally devised a bullish perpetual-motion machine. Think about it: DaBoyz move electronically traded index futures higher overnight on extremely thin volume, requiring U.S. stocks to play catch-up on the opening bell. This is usually accomplished by way of a gap-up opening that causes the Dow Industrials to leap a hundred points or more before anyone has had a chance to buy anything. Then stocks noodle around for the next five hours before taking yet another leap as the ETFs bring their holdings into line with all of the new buying that has taken place. Then rinse and repeat. No wonder some forecasters are predicting the Dow Average will eventually top 30,000 – presumably, even if the U.S. sinks into a Second Great Depression.

Kudlow’s Helpers

We have noted here half-jokingly that there is perhaps only one active buyer during the daily noodling-around period: CNBC’s irrepressible bull, Larry Kudlow. In reality, most of the buying is done by bears covering short positions that have gone awry. With the Indoos up 452 points so far this week, it’s a good bet that the shorts’ capacity to endure pain will be pushed to-the-max today ahead of the weekend. The effect may be even more dramatic than usual because yesterday’s short-squeeze left the Dow above 10,000, a number that many bears may have been counting on to turn back the tide. For our part, we shorted some Diamond August 102 puts yesterday for 3.70 apiece to neutralize a bearish position we’d taken in some August puts of a lower strike. The “backspread” position that has resulted will give us the luxury of enjoying the show if stocks continue on their crazed path higher – or even if they should collapse. That’s coming – and soon, we think. But in the meantime, it’s probably best to just run with the lemmings.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

http://www.telegraph.co.uk/finance/financetopics/recession/7883931/Obscure-book-by-British-adviser-becomes-cult-hit-after-Warren-Buffett-tip.html