[Gary Tanashian writes a technical and macro-fundamental analysis blog, is the publisher of financial website Biiwii.com and the premium-content, market-analysis newsletter Notes From the Rabbit Hole. In the essay below he explains how the interplay between inflation and deflation is used as a monetary policy tool by the Fed and U.S. Treasury. For the record, Rick’s Picks has long predicted a deflationary depression, but with a precipitous and devastating hyperinflationary phase. RA]

I would like to thank Rick Ackerman for the opportunity to continue a conversation that began in 2005 with an email I sent to him in response to an article he wrote about deflation that I felt was beyond the usual boilerplate that keeps insisting that a deflationary depression will bring all asset prices down. In fact, Rick’s constructive view of gold hints that he is not a knee-jerk gold booster like so many gold bugs, but rather a realistic believer in the idea that not all assets are created equal, especially during times of great monetary stress.

There are several notable deflationists who absolutely hate gold, which makes sense since they have been micromanaging its “price” demise since 2002. While they may be right for limited periods during an ongoing secular deflation against which ever more exponential inflationary policy is brought forth, they will never be right about gold’s “value proposition” in relation to assets positively correlated to growing (or more accurately, contracting) economies, at least during the current secular trend.

The garden-variety deflationist preaches global depression and cash-as-king. Well, he may be half right: cash is good for short-term liquidity and can play court jester, but gold is king of enduring value in the current system as policymakers fight the dreaded deflation beast ever-further off the macro balance sheets. More astute deflationists do not focus on asset prices, instead focusing on money supply, which by various aggregates is working on a plateau that makes the one leading into mini-Armageddon ‘08 look modest.

Excited Deflationists

Deflationists are, to say the least, excited by this. And when a deflationist becomes excited, he finds it hard to resist the urge to once again lecture the silly inflationists. Those would be the people that tout ever-rising commodity and asset prices (in many cases conveniently offering preferred investment recommendations) amid the debasement of fiat currencies. On the big picture, I tend to agree with them. But the inflationists have a funny way of going all quiet each time deflationary destruction happens to pay a visit along the continuum of inflationary regime.

It is advisable to tune out the cartoon aspects of both sides of the debate and realize that deflation and inflation go together in the current system. In fact, I believe that our heroic policymakers depend on periodic bouts of deflationary fears to boost the implied confidence that they need to continue — you got it — inflating; or at least trying to inflate. I have little doubt the game will end very badly one day soon, and it is open for debate as to whether the resulting depression will be deflationary or inflationary.

On the deflation/inflation theme, the following is excerpted from this week’s newsletter:

Inflation Impulse?

You may have seen my 2005 conversation about deflation with Rick Ackerman noted on the blog recently. That was probably about the time I came up with the term “deflation impulse”. It was a way of illustrating the view that systematic and ongoing inflationary policies are periodically interrupted by the need of the economy, markets and financial system to purge themselves of the toxins routinely injected by policy makers on a Keynesian business-as-usual continuum of diminishing returns.

The diminishing returns are of course measured in our gold ratios like Dow/Gold, for example, in which the Dow has endured a sustained bear market in “real” terms. Since the inflationary saturation point in 2000, the anchor to real money – gold – has acted as a light of truth shone upon the people who control “official” money and thereby attempt to control asset markets. I think I once wrote an article comparing gold to the kid in fifth grade who used to sit in the front row, hand up and ready to give every answer – not to mention tattle on other kids for a few more brownie points. That is gold’s role in the sordid world of modern money.

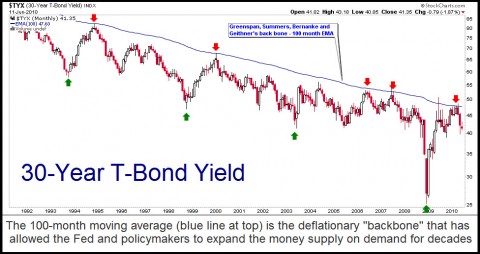

Not that it matters much to our analysis, but when reviewing the long-term monthly (see above) of the yield on the 30-year bond, it occurs to me that it is probably more appropriate to view our often-watched exponential moving average 100 as the deflationary “backbone” that has firmed up Greenspan, Bernanke, Summers and Geithner over decades of inflationary monetary policy on demand.

Prechter ‘Fright Mask’

Each time long-term interest rates have risen toward the EMA 100 – attended by bouts of rising inflation fears – they have been repelled (red arrows), as economies and/or markets have weakened and talk of deflation once again hits the media. This is the “Prechter fright mask” theme I sometimes have fun with on the blog. This dynamic is critical to policymakers’ ability to keep the game going. No stable T-bond, no ability to monetize confidence in the bond.

We are on a deflationary continuum against which monetary policy is eased in various ways and with varying degrees of intensity backed by the confidence implied by the EMA 100 backbone; there is implied confidence in the Treasury because each time there is a bout of deflationary activity, “investors” run en masse to U.S. Treasurys. Early subscribers may remember the “Lyin’ Larry” theme that NFTRH came up with at the end of 2008 when Mr. Summers very publicly cajoled the fearful masses to buy the safety of U.S. Treasury bonds, right into the teeth of an oncoming inflationary impulse that brought the yield on the long bond all the way back to the EMA 100. The fearful lemmings were summarily blown up as inflation players once again went full-tilt.

The Final Deflation?

So is this it, the final deflation? If so, a world of assets is going to decline hard and opportunity is going to be present for the “D Boys” to finally buy all those assets from all those frightened and naive inflation believers. Or are policy heroes preparing a mother of an inflation yet to come, with the recent decline in yield from the EMA 100 and the confidence (and mandate to inflate) that would come with a continued decline? The chart tunes out the inflation/deflation debate and simply states that for now at least, it is business as usual.

Nothing has changed over decades – although the impulsiveness of the 2008 decline can be read as a warning that things may have become more unruly in the macro markets. But even here, this begs the question of whether that was an initial downward thrust toward deflationary resolution or a harbinger of an equal and opposite inflationary reaction?

As has been the case since the “Hope ‘09” rebound got strongly under way, I am not going to read too much into either potentiality. Rates have neither strongly declined nor busted our EMA 100 “back bone” or “inflationary line in the sand”. Until one or the other occurs, we remain on the business-as-usual continuum, where implied confidence remains with our policymakers, and they can be expected to do as they have done throughout the continuum: They will sell Treasury bonds and monetize the debt in an attempt to keep business-as-usual intact.

Protecting Yourself

Smart investors stopped listening to Lyin’ Larry long ago and got off the modern financial Ponzi grid. It is really so simple: pay off debt, own insurance in the form of gold, have ample cash as long as confidence remains in fiat currency (don’t fool yourselves, this confidence remains embedded), become involved in productive endeavor whenever possible, and with an inner smile that comes from knowing you’ve done your best to get your house in order, go forth and speculate if you so choose.

To summarize the NFTRH stance, I would say that the structure of the macro situation is that of a deflationary continuum against which free license is given to policy makers to continue their regime of inflation on demand. Every time there is stress in the system (i.e., the U.S. credit contraction in 2008, or the European one in 2010), inflation – in the form of debt-based money supply ramp up – is brought forth. This cannot continue forever, but it takes a greater thinker than myself to be able to call it a wrap right here and right now. Eliminate debt, own value and pursue productive endeavor.

Rick, I spoke with you at Melinda’s last eve. I was the conservative screaming maniac. Still am. I constantly decry the lack of common sense these days. It is nice to see that it still exists on your site. Your posters have given me a mental inferiority complex, but I will continue to read none the less. My best to you and your lovely wife. Patrick