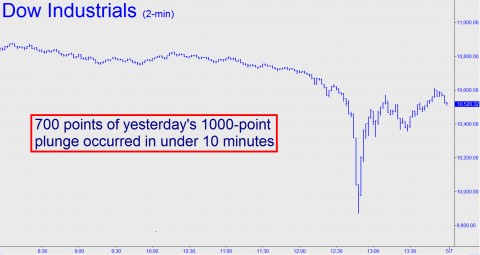

The panic we’ve all been waiting for hit like a tsunami yesterday, sending the Dow Industrials into a thousand-point dive, 700 of it occurring in under ten minutes. We’d warned of this just a few days ago when we wrote that the market was “vulnerable to a sudden, even spectacular, selloff.” Yesterday’s selling was indeed so ferocious that it might have gone on for another thousand points if not for Mr. Market’s addiction to round numbers. With the Dow down almost exactly a thousand points, the broad averages turned from their lows like a cattle stampede encountering a wall of fire. We should consider it a warm-up for the real panic that surely lies ahead. Thursday’s hysteria will be just a sound bite by the time it is replayed on the evening news, but when a truly destructive panic finally hits, it will run its course on Main Street as well as Wall Street. Safeway shelves will be stripped bare as quickly as stocks were stripped of value yesterday afternoon, and branch banks will run out of dollars before even a half-dozen customers have had a chance to deplete their accounts.

In this scenario, it’s hard to imagine that things would return to hunky-dory the next day. Grocery stores would find it impossible to keep certain crucial items, such as toilet paper and batteries, in stock. The same goes for the banks, which hold but one crucial item in inventory. But what of the stock market? Although the Dow had recouped 650 points of yesterday’s losses by day’s end, even the chirpiest news anchor would not deign to suggest that this warrants a sigh of relief. Anyone who watched the stock market come unraveled on a monitor yesterday could only have been infected with a sense of foreboding. Under the circumstances, asking the question “Will it happen again?” is like asking whether Greece’s intractable financial problems are likely to erupt anew.

The Babson Break

It was nearly 81 years ago that the so-called “Babson Break” occurred on Wall Street – a signal event that marked the beginning of the end for the Roaring Twenties. On September 5, 1929, Roger Babson, a leading entrepreneur of the time, warned in a speech that “Sooner or later a crash is coming, and it may be terrific.” Stocks fell 3% that day, as much in agreement with Babson’s outlook as caused by it. He was ahead of his time, but because he was just two months ahead of it, we remember him for his prescience. This time around, perhaps Bob Farrell, the legendary Merrill Lynch analyst, will qualify for a Babson Timing Award. He took a firm stand on April 11 with a forecast headlined “As Good as It Gets?” We’ll know in a month, if not sooner. Until then, we’d sooner trust Ahmadinejad and spring weather in Colorado than any rally on Wall Street.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Good question “other paul”. I will tell you that if the SPX doesn’t hit 1230 within the next 2 weeks it is all over.