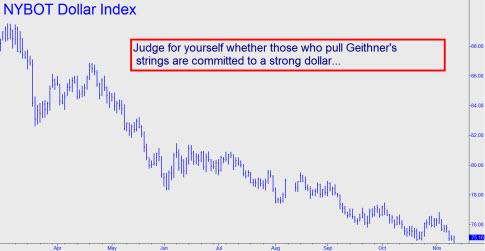

The literary critic George Steiner has argued that Germany was unable to produce any great novelists in the post-War period because the German language itself had lost its integrity and vitality in the service of Hitler’s and Goebbels’ nefarious goals. Is it possible the English language is about to suffer a similar fate, vitiated by the lies our leaders tell to make the nation’s reckless economic policies somehow seem prudent? Consider U.S. Treasury Secretary Geithner’s declaration concerning a “strong dollar” yesterday during a roundtable discussion in Tokyo for reporters: “I believe deeply that it’s very important for the U.S. and the economic health of the U.S. that we maintain a strong dollar,” said Geithner. “We bear special responsibility for trying to make sure that we are implementing policy in the U.S. that will sustain confidence not just among American investors and .. savers but investors around the world” that the U.S. will fix its budgetary problems as its economy improves.

Come again? Was the man perhaps speaking in code so that the reporters might read between the lines? We don’t know what kind of story they may have filed, but unless the journalists decided collectively in advance to bend over backwards to be polite, they should have laughed Geithner out of the room. For his part, the Treasury secretary treated the press conference like an open mike night at some third-rate comedy club. We doubt that he would have had the effrontery to make such ridiculous statements before, say, the National Press Club in Washington. D.C. Or would he have? Maybe we’re wrong about that, since not only did the Journal fail to ask any of the right questions, it did nothing to suggest anyone other than Geithner was present in the room. There were no quotes from Japanese officials, no questions from reporters, and no presence to evince even a mote of skepticism. The article’s author was one Takashi Makamichi, and we would infer that he was capable of translating any reactions that may have been critical toward Geithner. But if this was the case, Makamichi evidently decided not to rock the boat.

Health-Plan Sales Job

Geithner’s dog-and-pony show was similar to press conferences held in the U.S. to convince us that the Obama-Pelosi health plan will save U.S. taxpayers hundreds of billions of dollars. That straight-faced assertion did not get laughed out of the room either, and one might get the impression that The Government and the news media, Fox excepted, had colluded to bolster the ridiculous notion that the health plan will somehow benefit Americans without costing them an arm and a leg. We can only hope that the Journal’s many readers – the paper has the largest circulation of any U.S. newspaper – are devoting more time to the editorial page than to news stories. “The Worst Bill Ever” is how the Journal’s opinion-page editors headlined the definitive hatchet job on the Obama/Pelosi boondoggle. If reporters persist in seeing things the Administration’s way, however, it is going to require an even more elliptical departure from truth than the reportage of Geithner’s Tokyo talk.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Senior:

“Also gold has failed to reach a new high in the other currencies. ”

Does that not demonstrate the dollars weakness then?

“I say we’re ripe for a dollar rally very soon, no thanks to Timmy”

Perhaps then, the gold high in other currencies will be set, like it was in EUR early this year?

“This is deflation and gold will be strong, but the moonshot talk is all inflationista delusion. $1100+ was a good strong stab higher.”

If gold is not a commodity, whose value, measured in dollars, would decline during dollar-appreciation (=deflation), but rather if gold IS money (as it was for about 98+% of history), then should it not increase in value during money*appreciation (=deflation)?

Things above money on Exter’s pyramid decline in deflation, the lowest layers appreciate…

Though I do not know where to lump the layer+1 above money (T-bills, bonds, etc), they should decline too, but will they? Or will the sheep treat them, as so often before, as (better than) cash-equivalents, thus shuffling the layers?

My $0.10 (the copper-clad kind)