Clueless commentators attributed yesterday’s stock-market selloff to weak manufacturing data and supposed fears over job numbers due out Friday. What poppycock! The pundits would have gotten closer to the truth if they had cited sunspots or unusual seismic activity at Yellowstone. Shares plummeted for the simple reason that they were ready to plummet. Think back to March, when this bear rally began. Since then, when have traders evinced even a twinge of fear over economic data? In fact, they have ignored a steady stream of appalling economic news in order to obsess over a statistical recovery so ephemeral that it barely qualifies as a mirage.

What has “recovered,” mainly, is the stock market, which is in the throes of one of the most powerful bear rallies since the Great Depression. Some other green shoots sprung entirely from the imagination: a blip in retail sales attributable to the cash-for-clunkers giveaway; a blip in consumer spending – again, credit the clunkers; a blip in home sales that reflects the success of auctioneers, not Realtors; and a blip in home prices that is more dead-cat bounce than prayed-for inflation.

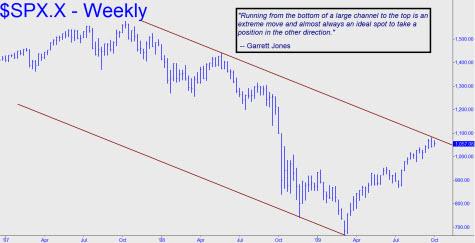

Not Rocket Science

Concerning yesterday’s broad plunge in the averages, it doesn’t take a rocket scientist to discern its cause. Just look at the chart above. The quote from our friend Garrett Jones, Bay Area forecaster, says it all: The rally from the March lows has been so extreme that it was bound to correct when it reached the upper threshold of its price channel. This is what we meant when we said stocks plummeted simply because it was time for them to plummet. The mood of investors has changed, and with it perceptions of the news. For the last seven months, as far as Wall Street was concerned, all news was good news. Now, no news will be good news. It is hubris itself that is about to slip back into a bear market.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

[For gold to enter into a massive parabolic phase, you need to see backwardation. Now, gold futures contracts do not tolerate backwardation well, as you would find in other commodities.]

Let’s not forget the largest backwardation we have seen thus far in gold happened when gold was making the biggest correction in 9 years. A rising gold price will correct backwardation. A falling gold price will tighten backwardation giving support to price. There is a floor to the price of gold and we’re very close to it right now as last year proved. Happy gold hoarding.