Our memory stumbles whenever we try to recall any recent sightings of “green shoots” that would support the officially promoted illusion of a U.S. economy in recovery. Actually, this vision is more of a hallucination than an illusion, since one’s mind needs to venture beyond the pale of rationality, light years beyond the fringe of statistical evidence, to conjure up supposed signs of sustainable growth. Does “recovery” square with the reality that you, personally, see all around you? Indeed, whatever picture the government and the news media want us to see will be unconvincing at best, since a hundred million Americans are each day living the anecdotal evidence that flatly contradicts what we are being told. How many of the 50 million homeowners who are underwater on their mortgages, for instance, jumped for joy when it was reported yesterday that home prices in the U.S. rose 0.3% in August? Optimists would say it’s the trend that matters, but realists would point out that at that rate, it will take a decade for prices merely to return to where they were before the housing market collapsed.

Someone in the Rick’s Picks forum said the news media were in cahoots with the government to sell us on the idea that America’s worst downturn since the 1930s has ended. Speaking as a former newspaper reporter and editor myself, I have a more boring theory — that journalists are simply too lazy intellectually to pursue a story line that doesn’t perfectly fit the Administration’s script. With some cursory background reading in Econ 101, they could nail Greenspan and Bernanke to the wall for their lies and sometimes appalling economic ignorance. But that would be a far more difficult story to write than the ones that flow so easily from the government’s press releases and speeches. Journalists’ other big problem is that 95% of them are hard-core liberals for whom Big Government, warts and all, will always be the answer.

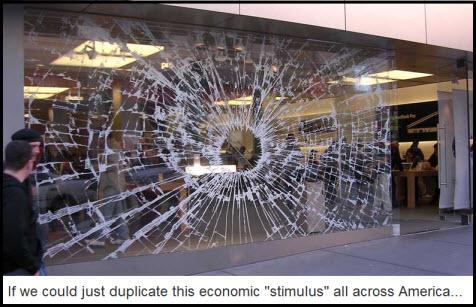

Bastiat’s Parable

Many of the reporters I’ve known have been very intelligent, but where economics is concerned, they seem incapable of understanding Frederic Bastiat’s so-called broken window fallacy. Bastiat’s parable, written in 1850, describes (from Wikipedia) “a shopkeeper whose window is broken by a little boy. Everyone sympathizes with the man whose window was broken, but pretty soon they start to suggest that the broken window makes work for the glazier, who will then buy bread, benefiting the baker, who will then buy shoes, benefiting the cobbler, etc. Finally, the onlookers conclude that the little boy was not guilty of vandalism; instead he was a public benefactor, creating economic benefits for everyone in town.”

And so it is for all those who continue to see Government as America’s economic benefactor — nay, savior. Would someone please explain to such as the New York Times, the Wall Street Journal, and other zealous purveyors of green shoots where, exactly, the fallacy lies.

***

If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Bastiat’s Broken Window of course puts to lie the Academic Shibboleth that FDR taking US into WWII got us out of the recession, and exposes the harvest of simultaneous wars in Afghanistan, Iraq and Pakistan with a broken US economy…

Speaking of Henry Goldman Pulitzers (he got his law degree before Bloomberg) and editors spiking stories at the order of media mogul owners or advertisers, Julian Robertson gave an excellent half hour interview with Erin Burnett of CNBC.

JR sees 15-20% interest rates, still fighting the last war of inflation, not realizing that when we add nominal rates to the -33% drop in durable goods imports and production (DRYR down -53% since May), we have the highest real iRates in history. He used the phrases Pay the Piper and Almost Armageddon to describe how codependent we are on China and Japan.

With Baltic Dry Index down -49% since June, China, Japan, Russia and the House of Saud UAE may tire of carrying USA trade and budget deficits and turn their trade surpluses toward domestic spending.

Thus JR’s reco to buy the Norwegian Kroner, 10th largest oil proiducer, 4th largest oil exporter, 2nd largest pension fund, and richest country in the world with just 4 M people.

We respectfully disagree. Our opinion is we may see another Leo Wanta style currency operation benefiting the dollar…

Regards*All