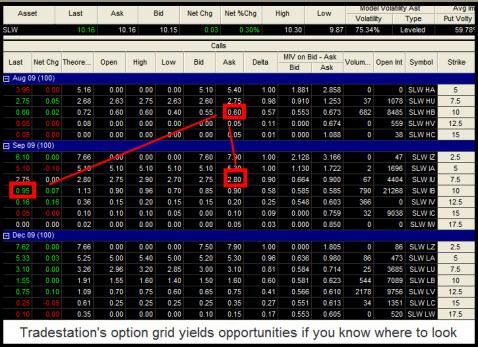

Because our immediate outlook for silver turned very bullish recently, we took steps yesterday to protect profits in a key precious-metals stock that we hold, Silver Wheaton (SLW). It was four months ago, in early April, that we advised subscribers to stake out a small position, buying four September 10 calls for 0.69 with the stock trading around $8. Silver Wheaton subsequently moved sharply higher and is currently trading for around $10.24. The call options rose in value commensurately and were quoted yesterday at 0.90, but the theoretical gain from the position is nearly six times the implied 21 cents. That’s because, as SLW moved higher, we sold options short against those we held, effectively turning the position into a calendar spread: long four September 10 calls vs. short four June 10 calls. Even better, because SLW took a sudden leap higher when we were offering June 10 calls short, we managed to sell them for 0.80 on the spike –11 cents more than we’d paid for the Septembers. Come hell or high water, this locked in a theoretical gain of $44 (i.e., 4x 0.11) on the spread.

Ever since, we’ve adjusted the position, employing what you might call a “shampoo” regimen: rinse and repeat. And so we did, rolling into the September-July calendar spread when the Junes expired; and then rolling once again into the September-August calendar spread when the July calls expired. In both instances, the underlying stock was trading for about $10 when we did the roll, allowing us to extract maximum value from the short sale of the option next to expire. The net result is that we now hold the four calendar spread effectively for a net CREDIT of 0.90. If you add the current value of the spread (0.30) to that sum, the $1.20 credit thereof yields a hypothetical gain of $480 ($1.20 per spread x 4).

Pussyfooting Pays

This isn’t too shabby, considering the stock has been pussyfooting near the $10 level for the last few months. But that was our intention: to reap substantial gains even as SLW simply hung out around $10 for a while. Now, however, the stock looks like it’s ready to move up to another cruising altitude – $12, perhaps – there to shuck-and-jive for who-knows-how-long. And that is why we adjusted the position yesterday, since the August 10 calls we are short are going to turn into 400 shares of short stock if SLW is trading above $10 come August expiration in a little more than two weeks. The four September calls that we hold as the long side of our position do not quite hedge that exposure, since each is worth the equivalent of about 60 shares of stock. To mitigate this small risk, we simply bought two September 7.5 calls yesterday for 2.80. That left us “delta neutral,” but with stock equivalents that have effectively reduced our cost basis to around $5 per share.

Managing risk in this way is the subject of a magazine article we wrote a while back for Stocks, Futures & Options magazine. If you would like a copy, click here to access the pdf file.

***

Last Call for Night Owls

There’s good news for traders who were unable to attend the Morning Briefings that Rick held in June before the opening bell. To gauge demand for a late-hours briefing, especially from traders in Europe and Asia, Rick has been holding Midnight Briefings this week. Tonight will be the last such session, and it is scheduled to begin at 12:01 a.m. EDT. Click here to sign up.

The 20-minute session will begin at 12:01 a.m. EDT (GMT-5:00). During this time, we will attempt to identify timely trading opportunities mainly in the E-Minis and Comex Gold. Last month’s briefings were enormously popular, drawing as many as a thousand traders on some mornings. To reserve a place, register now.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)