The S&P 500 Index played footsies with the 1000 barrier yesterday, but bears looking eagerly for a major top shouldn’t rely too heavily on the stopping power of this benchmark. One reason is that Dow 10,000, a marquee number with greater importance, is still 700 points away. We should also mention that at yesterday’s closing price of 9286, the Indoos lay almost 200 points shy of a 9476 target that we flagged a while back as a minimum rally objective. There is also Goldman Sachs, a favorite bellwether of ours that we’ve been expecting to reach a minimum 173.10. Yesterday the stock pushed as high as 166.29 before settling back to 164 to catch its breath, but it looked feisty enough to cover the remaining distance to the target without much effort.

Taken together, these unachieved rally targets suggest the bull still has some running room, although it’s possible that Dow 9476 could prove to be a rally-stopper. That number is a “Hidden Pivot” resistance, and it is sufficiently well defined on the daily chart to be considered reliable within about 10-15 points. That means that if the Dow trades above 9491 intraday, or settles for two consecutive days above 9476, significantly higher highs – in this case, Dow 10,000 – would become more likely, if not quite yet an odds-on bet.

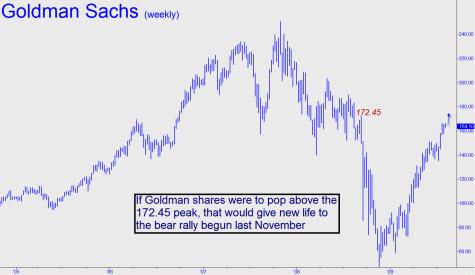

Goldman’s Running Start

The rally in the broad averages dates back to March 9 officially, but as you can see in the chart above, Goldman shares got a running start that began more than three months earlier. The stock’s trajectory has also been quite a bit steeper than that of the broad averages, and that is why we have regarded it as a key bellwether all along – a high beta stock with the power to pull other stocks higher with it. The thing to notice about Goldman right now is that a thrust to the 173.10 target noted above would slightly exceed a 172.45 peak recorded last September. That would refresh the bullish trend on the weekly chart, and, probably, extend the bear rally into year’s end.

***

Midnight Briefing Tonight

There’s good news for traders who were unable to attend the Morning Briefings that Rick held in June before the opening bell. To gauge demand for a late-hours briefing, especially from traders in Europe and Asia, Rick will hold a Midnight Briefing on three successive days his week: tonight, Wednesday and Thursday, August 4,5 and 6, starting just after midnight EDT. Click here to sign up.

These 20-minute sessions will begin at 12:01 a.m. EDT (GMT-5:00). During this time, we will attempt to identify timely trading opportunities mainly in the E-Minis and Comex Gold. Last month’s briefings were enormously popular, drawing as many as a thousand traders on some mornings. To reserve a place, register now.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Great take on the fact that the Dow more so than the S&P is the more emmotional indicator of the two, my thoughts exactly. The only thing is, I think if we get to 10,000 we could punch through it in an effort to draw in the last dime of the “dumb and desperate money”, the “goldilocks crowd” . Certainly a convincing puncture of the vaunted 10000 mark would convince all but the most perma-ist of bears that the economy is on the mend . Goldman Sachs made their money off the shorts in the second quarter, they may make it off the longs in the third and fourth.

BTW anybody see the USD today? Up a full point, what up wit dat? Somebodies got “happy feet” possibly someone in the emmerging market bubble which appears to be slowing.