Although two big companies, Microsoft and American Express, reported atrocious earnings yesterday after the close, we shouldn’t expect the news to slow the relentless rise of stocks for long. Investors were obviously blithely unconcerned about earnings on Thursday, showing their eagerness to buy stocks by pushing the broad averages to their most impressive gains in nearly two weeks. The S&Ps settled at 976, up 2.3% on the day, and looked like an even-money bet to achieve their biggest back-to-back weekly gain since March. The index has risen almost exactly 50% since bottoming in early March at 666, but it wasn’t even breathing hard after yesterday’s steady climb.

Our forecast calls for a potentially important top at 998, but the S&Ps would have to do a little better than that, hitting 1008 before pausing for more than a day, in order to firm the case for significantly higher numbers into summer’s end. In any event, the milestone number 1000 can be expected to exert an irresistible, magnetic pull on the S&Ps.

Taking Bad News in Stride

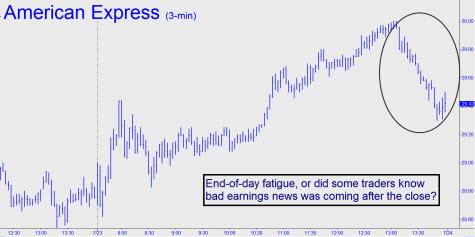

It is of course bullish when the stock market is able to take bad news easily in stride and to see the bright side of every statistic. Yesterday, for instance, investors ignored word of yet more weakness in home prices, focusing instead on the third straight monthly rise in existing home sales. Friday’s opening will put investors’ blithe mood to the test, however, since trading will reflect universal knowledge of problems at two very widely held companies. After the market closed on Thursday, Microsoft announced that earnings had fallen by 29; American Express’s earnings for the same period were off by 48%. Shares of the latter fell 4.6% in after-hours trading, to 28.05, while MSFT was down 7%, to 23.73.

If the stock market continues a pattern that has played out numerous times in recent months, both of these stocks will struggle during Friday’s session and the broad averages will be under pressure as well. However, by day’s end, expect to see most issues trading well off their lows, even if MSFT and AMX haven’t recovered quite as much ground. Overall, the action should leave bulls and bears alike feeling as uncertain as ever about what Monday’s opening might bring.

If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.

I will keep saying, GS MUST HIT 178 +/- before any significant downturn…this is my 3rd proclamation

&&&&&

You’ll go down in history if this prediction pans out, Corey, and they’ll have to build a new wing in the Guru’s Hall of Fame for you. By my runes, 173.02 could be the magic number. Maybe one of us will be close? RA