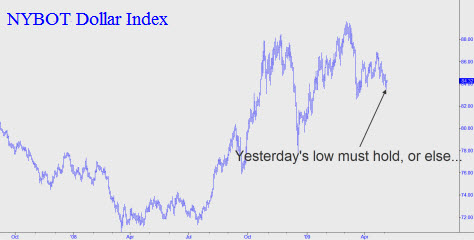

Is the dollar about to collapse? We’ll know soon enough, since the U.S. Dollar Index fell yesterday to within a hair of an important correction target that we flagged for subscribers a couple of weeks ago. The actual target was 83.45, a Hidden Pivot support that lay just 0.05 points beneath yesterday’s actual low. We’d expected a bounce from our target, and it came in the form of a sharp rally of 0.81 points off the intraday low at 83.50. However, the surge would need to continue to at least 85.29 by Wednesday’s close to confirm a bullish reversal of the downtrend that has dominated since April 20. On that day, the corrective rally of an even larger downtrend topped at 86.82.

Putting the dry technical details aside, these numbers are important because they imply that the dollar is hovering at the edge of a cliff. Indeed, if the 83.45 support were to fail decisively, it would signal more downside over the near term to at least 80.05. A five percent decline may not sound like much, but there’s a strong case to be made that any slippage below 84 will be the beginning of the end for the dollar. If so, we could expect a collapse in Treasury paper that would instantly devastate The Government’s already doomed plan to resuscitate the economy by holding lending rates down across the yield curve.

Bond Gains Erased

Treasury rates have surged since mid-March, when the Fed announced it would start monetizing debt via direct purchases of Treasury debt. Bond prices staged their biggest rally ever on that day, pushing yields down to their lowest level in many decades. However, any benefits thereof have been erased, since the slippage in bond prices since then has pushed yields above where they were when the monetization scheme was announced. Now, if the Dollar Index were to settle for two consecutive days below 83.45, we would infer the worst. A reprieve would be signaled by a thrust to 85.29, the number mentioned above, but if it doesn’t happen soon, we could probably kiss the dollar good-bye. Looking at a bigger picture, it would take a print at 91.17 – roughly eight percent above these levels – to signal a likely end to the bear market begun in early 2002 from 120.51.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Won’t another round of deleveraging create demand for dollars again? Bob Hoye always says that on aspect of a post bubble contraction is chronic strength in the senior currency, although I thought I heard him say the other day that the Pound didn’t do well in the 30’s. Was that not then the senior currency? I don’t know.

I’m expecting the market to turn weak soon, and the dollar to perhaps strengthen a bit in the early stages, though I think all fiat will eventually reach its intrinsic value.

&&&&&&

You can never go far wrong following Bob Hoye, whose analytical perspective spans centuries rather than the mere weeks, months and years that preoccupy the rest of us. He has oftened mentioned the dynamic of a stengthening “senior currency” during the collapse of credit bubbles, and I doubt this time will be any different. My own forecast for the dollar is a little more bearish than Bob’s, at least over the very near-term, in that it calls for a low at 80.05 in the NYBOT Dollar Index that has yet to be reached. I think a strong dollar thereafter is logical because that will give deflation the power to crush, asphyxiate and disembowel all debtors as a proper deflation should. Meanwhile, you can ignore all the blather about inflation/deflation being an increase/decrease in the money supply, since no one — least of all the inflationists who speak in such useless terms — seems to know any longer what constitutes money, and how momey works.

Regarding deflation, the easiest way to understand why it will continue until the economy is wrecked and everyone is in the poorhouse, is to think of it first of all as an increase in the real burden of debt. That is what is occurring now, and, as I have asserted here numerous times, it is highly doubtful that this crushing trend will reverse in time to bail out tens of millions homeowners who are underwater. In the meantime, as I have suggested above, you can tune out the inflationists, since the only one who has made a plausible case is Peter Schiff. He sees the Fed as eventually monetizing all bonds, not just Treasurys. I think he’ll be right, but, to repeat myself, not before the mortgage bust has played out to its logical, ruinous endgame. The fact that the dollar is already fundamentally worthless must at some point produce inflation. But it will come in due time, its purpose being to wipe out creditors and savers who have survived up to that point. RA