The back-of-the-napkin numbers sketched out below are the handiwork of our good friend Doug B., a stockbroker who not only helped his clients dodge the bullet of recession/depression, but who also brought them some tidy returns on their portfolios last year. Doug got his clients out of stocks and heavily into Treasurys before the latter took off in 2008, and he has since redeployed the proceeds aggressively in municipal bonds. During our lunch together on Wednesday, he presented a very persuasive case as to why only an imbecile or someone enthralled by Larry Kudlow could possibly think the stock market has seen its ultimate lows. The fatal problem for that kind of optimism, he says, is, in a word, capitulation — or rather, the absence of capitulation in a bear market that so far has been marked by more or less orderly declines the whole way down. Indeed, we should ask: How could the stock market have hit bottom if everyone who was on board at the top is still on board?

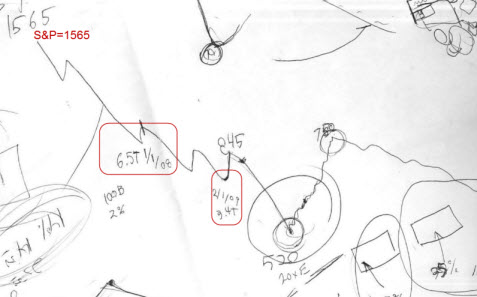

And everyone is on board, for sure, if you parse some of the key numbers circled in red on Doug’s tablecloth pastiche (which, incidentally, he drew and labeled upside down). The first number notes that in January 2008, when the S&Ps were in the early stages of what was to become a devastating collapse, domestic equity mutual funds were worth about $6.5 trillion. Lo, a little more than a year later, in February 2009, we see that the value of these funds had fallen by about 48%, to $3.4 trillion. But guess what: Over that time, net redemptions totaled only 2%, or about $100 billion! What that means, explicitly, is that mutual fund investors have stuck with this bear market throughout the decline.

And everyone is on board, for sure, if you parse some of the key numbers circled in red on Doug’s tablecloth pastiche (which, incidentally, he drew and labeled upside down). The first number notes that in January 2008, when the S&Ps were in the early stages of what was to become a devastating collapse, domestic equity mutual funds were worth about $6.5 trillion. Lo, a little more than a year later, in February 2009, we see that the value of these funds had fallen by about 48%, to $3.4 trillion. But guess what: Over that time, net redemptions totaled only 2%, or about $100 billion! What that means, explicitly, is that mutual fund investors have stuck with this bear market throughout the decline.

Wholesale Dumping Ahead

So, do we infer that guys like Kudlow, Suze Orman and CNBC’s talking heads actually believe this bear market will somehow be different from all others before it, with no exhaustion selling to carve out a durable low? We do not merely doubt this, we view such an outcome as very nearly impossible. This bear market will end, like every other bear market in history, with a wholesale dumping of stocks at prices that will make current values seem exorbitant in comparison.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Rick,

As always, a short, yet precise, comment that really focuses in on the heart of the matter.

As this is a belated comment, in case you do still see it, a question:

Next to the lack of capitulation that always accompaines bottoms, what about the simple metric of bottom P/Es?

To my knowledge, in virtually all instances comparable to this decline (are there many that compare) the S&P’ s P/E has gone well BELOW its long term average of 12-15, to hit about 6-8 at the bottom. Yet today, we are still well ABOVE the LTA, I don’t have access to the numbers as you do, but I think that the CURRENT P/E is still above 20.

So of course, if the market had seen its lows already, we could still get to an 8 P//E if earnings go to about $100, a mere 150% increase over the current number

Now how likely is such an earnings outlook?

Rick, do you think this P/E metric in its simplicity for bottom evaluation is comparable to your friend’s as sketched out above?

Personally, I think there is a good case in waiting for the Dow/Gold to go from 9 now to maybe 2-3.

As I am penning this in the wee hours of Eastern Sunday, a happy Easter to all (and holidays of course)!

&&&&&

The P/E multiple is a wildly variable number that ultimately reflects investors’ state of mind as it swings between cyclical extremes of fear and greed. Given the historical excesses of greed that we have seen in this last cycle, it seems likely that P/Es are about to fall to historical lows as fears mount. That would suggest that earnings multiples have quite a ways to fall from current levels, especially since collapsing earnings will be pushing P/Es much higher over the next year or two. RA