In forecasting gold’s price trends, Rick’s Picks has generally been careful not to let our long-term bullish bias color our observations from one week to the next. We think readers deserve straight talk, even when it has less than bullish implications for the precious-metals sector. Such as now. We are not so much negative on bullion as we are more cautious than usual. Specifically, we don’t expect gold to leave the $1000 barrier behind any time soon — meaning within the next three or four months; rather, we foresee a choppy correction over that time that could bring quotes down to $800 or even lower. There are no compelling Hidden Pivot targets to buttress this prediction, only a Fibonacci level at $811 that we would not count on too heavily for precise support.

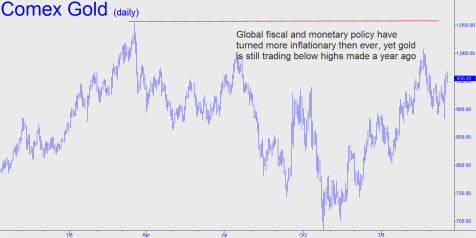

Why the dour outlook for the intermediate term? The reason is painfully obvious: With fiscal and monetary policy more inflationary than ever in the U.S. and around the world, gold should already be trading well above $1000; but it is not. We won’t dwell for long on why, since there are many plausible reasons. Suffice it to say, deflation has decimated the investment resources that institutional players might now be deploying speculatively and/or defensively in gold. Yes, we too have read about all of the cash supposedly sitting on the sidelines. We don’t believe it, not at all, nor should you. It seems entirely likely that much or most of it will turn out to have been, in a manner of speaking, Bernie Madoff money. For no one should doubt that the global financial system is every bit as fragile and ephemeral as Madoff’s criminal empire. His financial edifice was a Ponzi scheme through design; ours was a Ponzi scheme that we perpetrated on ourselves — a manifestation of greed and stupidity that swelled our faith in free lunch to an epochal flood tide.

A Bulletproof Defense

The resulting bust has brought on a true global crisis that has devastated financial markets and erased perhaps $80 trillion of asset values from investment portfolios. As a consequence, institutional investors have grown so fearful of a systemic crash that they have shifted allocations toward the only “sure thing” their feeble imaginations –and the Rules of the Game — will allow: Treasury paper. Not stocks. Not real estate. Not derivatives. Not even gold, which has been buoyant but hardly frenzied. Gold may be a riskless investment according to some gurus well-known in hard-money circles, but in the world of pension funds, insurance companies, banks and other agents of investment orthodoxy, gold remains the province of lunatics, schemers and enemies of the American Way. Contrast this with the spectacle of white-shoed money managers climbing onto the Treasurys bandwagon. They have good reason to fear the day when they will be hauled in front of a tribunal to justify their investment decisions. Can you blame them for thinking U.S. Bonds will offer a bulletproof defense?

Goldbugs should therefore be neither surprised nor disappointed by bullion’s failure to catch fire. They should instead take heart from the fact that gold has performed quite well relative to all other classes of investable assets and is likely to continue to do so regardless of how things play out. Concerning the big picture, we can only imagine two possible scenarios. The more likely, in our view, is that deflation will deepen until all debts have been liquidated through bankruptcy. This is what we should expect if fiscal and monetary nostrums continue to dribble out a “mere” trillion dollars at a time. This is nickel-and-dime stuff compared to the asset deflation occurring throughout the world. However, if the slow, deflationary death this approach produces proves too painful economically and politically, then hyperinflation will at some point be employed, even if it destroys creditors and savers for a generation in the process.

Targets for Comex Gold

In the meantime, our outlook for gold in all time frames will remain flexible, subject to suble changes in the technical picture. Most immediately, we are looking for a decline Sunday night or Monday morning to 949.00, (basis Comex April) or to 938.50 if any lower. A penetration of the lower number, a Hidden Pivot, would increase our bearish bias for the near term. Alternatively, the short-term picture would brighten considerably if the futures are able to close above 984.80 for two consecutive days. (Want to learn more about the Hidden Pivot Method we use to identify these price targets? Click here to register for a free webinar demonstration Tuesday morning during market hours.)

Rick,

I’m curious. What can the short and long term chart of Goldcorp (GG) tell us about the future price of gold? If you assume that the bull run for GG started in December of 2000 then you can draw a straight uptrend line from there to the present, using the lows of August, 2007 as the second point. (Log chart, using Prophet JavaCharts) (I did the same with the DJIA going back to 1982, with the second points being 2002/2003 to determine in January of 2008 that the bull run in the Dow was also over. Nothing has happened since to change my mind)

So this trendline support for GG held through August, 2008, when the price bounced off the support, only to crash through it in September. And crash it did, breaking the support at ~30, and falling all the way down to 13.81 on a trading basis. Depending on what you use for analysis, the stock reached a high of 52.44 and fell ~74%. Did gold fall 74% from its high? Not yet.

To continue the analysis of GG, if we use Fibonacci numbers to predict how high the recovery should be, at 61.8% we get 37.68, if I’m doing this right. Since the crash GG it has traded back to the previous support (now resistance) in December, fallen back, and now is making another run at the line. Happens to be that both the resistance line and the Fibonacci number is about the same.

My analysis is that the bull run in gold is over with. Why else would the gold stocks have gotten destroyed in the crash of 2008? Look at any of the serious stocks and they all crashed through long term support.

As for the argument that all the Fed money is going to cause inflation, and therefore a rise in the price of gold, all these assumptions are based on a recovering economy. But what happens if there is no recovery? What happens if we continue in a credit contraction for the next few years? What happens if all the funny money “created” by AIG and company continues to disappear? We are in the midst of deflation, and once deflation gets started its almost impossible to stop, until its run its course.

You have to add something else to the pot. Approximately one quarter of the population is in retirement mode. Falling incomes, falling expenditures, shrinking labor force all translates into a 10-15 year fall in consumer spending. Just how is inflation supposed to rear its ugly head in this kind of environment?

Thanks,

Andy