Over One Thousand Paid Subscribers Won’t Make A Trade Without Looking At Rick’s Picks First…

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Rick's work has been featured in

Rick's Free Picks

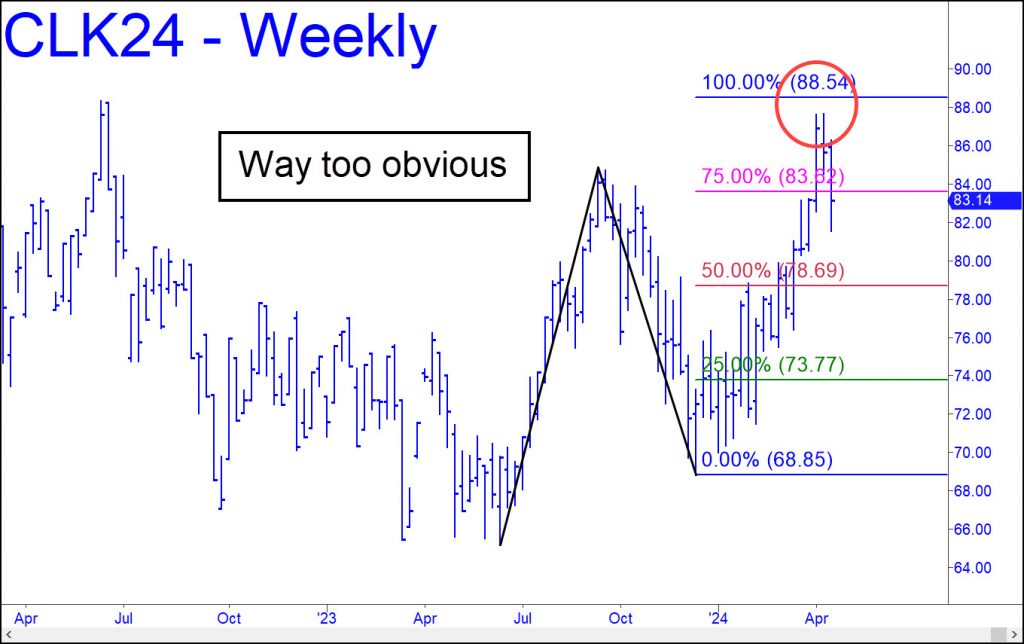

$CLK24 – May Crude (Last:83.14)

Although 2024’s steep rally from $69 failed just shy of an important Hidden Pivot target at 88.54 (see inset), I expect a second-wind push to get there, surpassing the key external peak at 88.31 recorded in June 2022. That would create an impulse leg of weekly-chart degree sufficiently powerful to

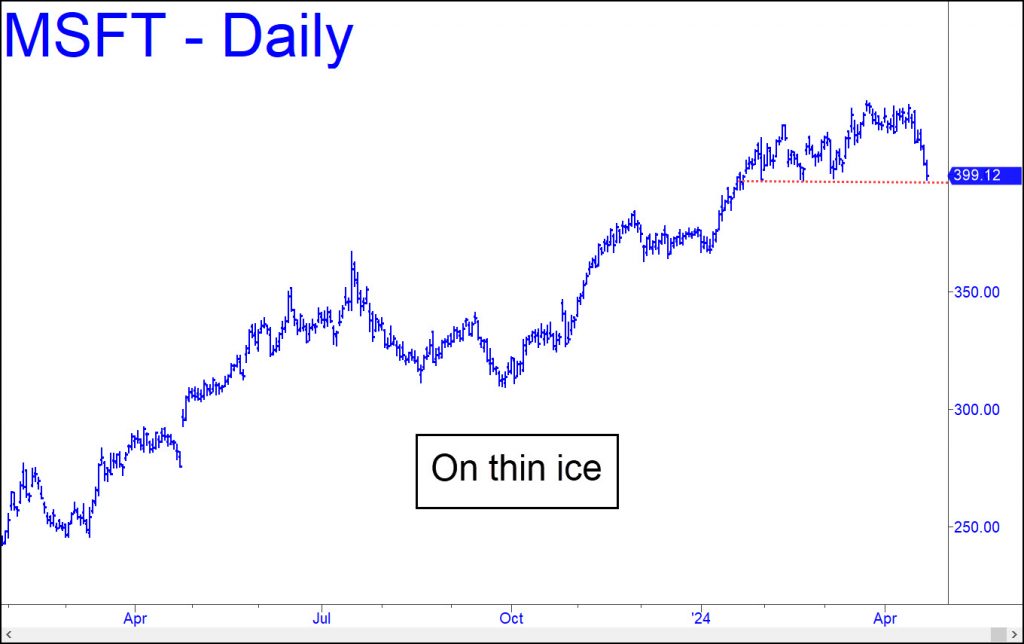

$MSFT – Microsoft (Last:399.,12)

The stock’s steepening fall last week put more distance between it and the all-time high a month ago at 430.82. That was just 24 cents from a longstanding target I’d said could cap the bull market begun in 2009. Perhaps it has, although I’d like to see MSFT fall at

$DXY – NYBOT Dollar Index (Last:106.12)

The previous tout suggested the dollar could range-trade for a long time between 100 and 110. However, if it merely pushes above the 107.99 ‘external’ peak shown in the chart, that would command our attention and respect. It would also be something to fear, since a resurgent dollar would put

$TLT – Lehman Bond ETF (Last:88.88)

Bulls continued to lose ground last week, but the weakness was not quite sufficient to push this vehicle beneath the 82.42 point ‘C’ low of the bullish pattern we have been using speculatively. If the pattern were to hold sway, which is looking increasingly doubtful, an extended uptrend could take

Member Content

Unlock member content with a free trial subscription

THE MORNING LINE

Prepare to Sell in May and Go Away

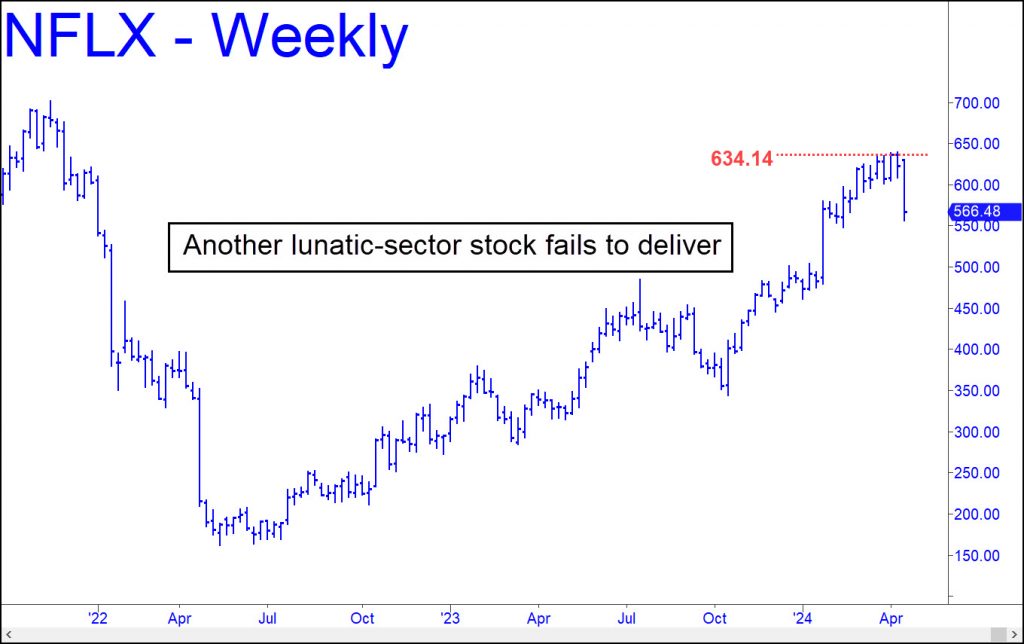

The portfolio managers who rig the markets appear to be losing their touch. Usually, they are able to short-squeeze stocks in the ‘lunatic sector’ — our label for the egregiously mis-named ‘Magnificent Seven’ — when earnings are announced after the close. This quasi-criminal manipulation can add hundreds of billions of dollars to the world’s ‘wealth effect’ in a literal blink of an eye when it occurs in a mega-cap stock such as NVDA or AAPL. But the greedy con-game conspicuously failed to ‘grow wealth’ on Friday after Netflix reported adding droves of new subscribers in the previous quarter. The good news supposedly caught dull-witted analysts by surprise, even though a half-smart chimpanzee could have seen it coming after Netflix put the screws to millions of viewers who had been using friends’ passwords. The stock should have vaulted into outer space, since, in a bull market, all earnings announcements are treated as wildly bullish regardless of whether the news is actually bullish. That’s how bull markets work.

Not This Time

Not this time, though, Instead of taking the obligatory short-squeeze leap into outer space, Netflix feebly head-faked to stop out a $640 peak from ten days earlier by a paltry $1. That peak and Friday’s slightly higher one merely dented a Hidden Pivot resistance at 634.14 that we’d told subscribers a couple of weeks ago could cap the bull-market. On Friday, if everything had gone according to the script after earning were announced, the stock should have begun to gyrate wildly, allowing DaBoyz to work the swings like killer whales herding dolphins. Lo, NFLX simply continued to fall, ending the day $90 below the fake-out high.

Ordinarily, we wouldn’t read too much into DaBoyz’ failure to hold NFLX aloft so that they could distribute millions of shares to widows, pensioners and orphans. But taken together with Microsoft’s month-long failure to surmount a $430.58 target we’ve been drum-rolling loudly since 2023, it suggests the 15-year-old bull market is struggling for air. Bottom line: If MSFT continues to pussyfoot beneath $430 and to fall further from the ‘Hidden Pivot’ with each selloff, investors had better prepare to pack up in May and go away.

What our customers are saying about us...

Forecasts Delivered Before

The Morning Trading Bell Rings

As a Rick’s Picks subscriber, you will be getting this information the moment it’s posted on the membership site, usually shortly after midnight Eastern Standard Time… more than enough time to capitalize on Rick’s suggestions.

Then, throughout the day as Rick updates his forecasts with additional guidance based on market conditions, you’ll be instantly informed via email alerts… allowing you to take full advantage of breaking trends and market fluctuations.

These picks include a rotating basket of stocks, futures, indexes, and other hot issues, with a daily focus on precious metals. Rick’s Picks subscribers have their favorites, so Rick regularly covers Comex Gold & Silver, the NASDAQ, the Euro, and the E-Mini S&P in addition to the hot issues he believes will offer significant profit-taking opportunities for his subscribers.

Each specific pick is hand-selected by Rick, and includes actionable trading advice, specific price targets, and annotated Hidden Pivot charts with supporting data.

Your Free Subscription Includes:

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- ‘Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Your Satisfaction is Guaranteed

Once you see how powerfully accurate Rick’s forecasts truly are, we’re sure you’ll stay on as a full member. But if for any reason you’re not convinced, simply cancel before the two week’s end and you won’t owe us a single dime. Fair enough

Paid Subscriptions We Offer

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others